How to bootstrap your marketplace

This is the second part of the complete guide to marketplace funding. The previous post introduced a framework for creating a funding strategy. In this article, our CEO Juho discusses an approach familiar to most early-stage marketplace founders: self-funding, or "bootstrapping".

Published on

Last updated on

In the beginning, there's just you and your marketplace idea.

In most cases (there are exceptions), a great idea isn't enough to raise external funding. You first need to get your business to a stage where you can show your idea has potential. At least, this means validating your problem-solution fit, described in the first article of our marketplace funding guide.

Reaching product-market fit already requires some capital, which often comes from the marketplace founder's pocket. This process of self-funding is commonly referred to as "bootstrapping."

In this post, I’ll share the strategies for successfully bootstrapping a marketplace business and discuss what every bootstrapper needs to consider. I’ll start by briefly listing the situations where bootstrapping is the right choice for a marketplace business.

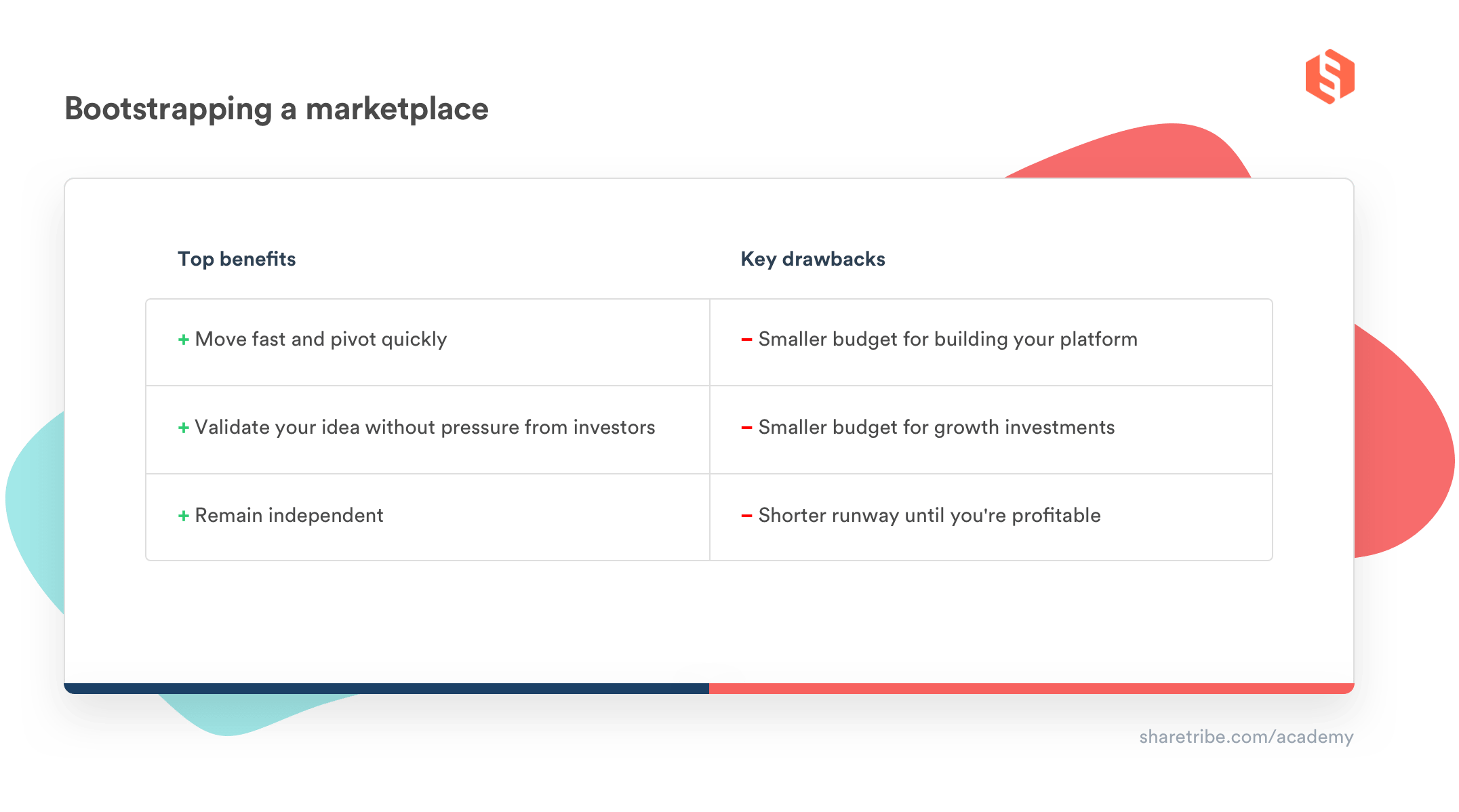

There are many reasons why you might choose to bootstrap your marketplace business:

- It’s the only funding option available.

- You don’t need the money (yet).

- You want to remain independent.

Have a look if any of these reasons apply to your situation.

Many early-stage marketplace businesses have no need for external funding. Thanks to new technologies, the cost of starting a marketplace business has gone from tens of thousands of dollars to a fraction.

For example, let's say you're targeting a relatively small market that doesn't face heavy competition. Chances are, you can launch the first version of your business and validate your concept without significant upfront investments in either technology or marketing. Or you might be targeting a bigger market but have some resources to invest in building a marketplace MVP and the initial marketplace user base.

If you are in a situation where you can reach your next business milestone without external funding, I recommend you do it. Spending time trying to raise capital only gets in your way and slows you down.

Even if you're sure you'll raise venture funding later, it could be a good idea to bootstrap for as long as possible. When you’re running a profitable business, you're in a much better position to negotiate with investors – and say no if you're not happy with their offer.

Moreover, most venture capitalists who invest in marketplaces want to see traction: prove that your marketplace works and generates revenue. If you can demonstrate that you self-funded your marketplace to profitability, your business is immediately more attractive in the eyes of investors.

Any external funding you raise, no matter the source, comes with strings attached. The party that funds you wants you to accomplish certain things with that funding. Typically, that thing is a hefty return on the investment.

When you self-fund your business, you retain control. You have no obligations towards anyone. And you're the only one who benefits from the proceeds.

Unless you're in a big winner-takes-all market (which, in the end, are rare – that's why the companies that win them are called unicorns), building a real business can be an attractive option. Bryce Roberts, founder of Indie.vc writes:

"Real businesses make products and sell them for a profit. They focus on customers, revenue and profitability – not investors, valuations and the next fundable milestone. Real businesses prioritize their customer's needs over their customer's eyeballs. They have a functioning business model, not a believable financial model. Real businesses want to stay in business, not run for the exit. They create their own source of funding and don't have to ask anyone for permission to exist."

Successfully bootstrapping an online marketplace boils down to three things:

- Keeping your marketplace costs down. This applies to both technology and marketing.

- Ensuring you have sufficient runway. Keep your day job as long as you can.

- Generating revenue early on. There are many things you can try here!

A marketplace business that is bootstrapping needs to be extremely cost-conscious. Start by creating a budget that details how much capital you have and how you plan to spend it to reach your goals. Include the sources of that capital. And calculate how many months you can afford to run the marketplace with your cash reserves.

I'm assuming that you are not a millionaire (yet), so your pool of funds is limited. A successful bootstrapper also thinks about ways to generate as much revenue as possible quickly. Let's take a look at the strategies to keep costs in check and maximize early-stage revenue.

When you're bootstrapping, it's a given that you should minimize the amount of money you need to spend. Your three most important sources of costs are your living costs, marketplace technology costs, and marketing costs.

I'll leave the first category for other experts to discuss and dive right into practical strategies for making the most of a limited technology and marketing budget.

Every marketplace entrepreneur should solve the problem/solution phase with as little funding as possible. Avoid building anything too sophisticated before you have validated that your solution can solve a real problem for people.

In the early stages, cutting costs justifies doing things that don't scale. Solve your users' problems manually and "fake the product" before you have the budget to build automated workflows. Stay focused on a niche and target a small number of initial users to keep your costs down execute quickly.

Once it's evident that you need software to move to the next stage of your business, look into existing software solutions instead of building from scratch.

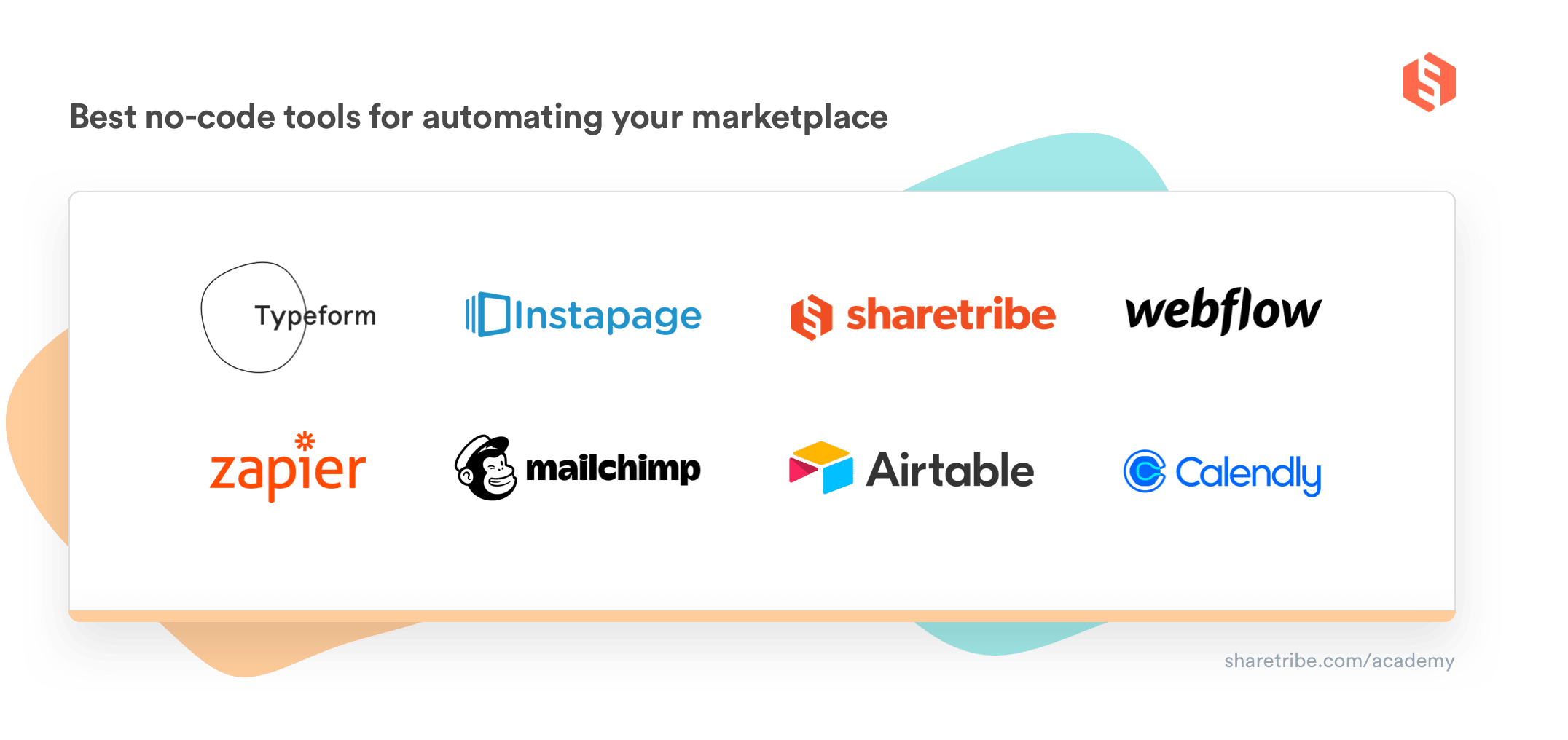

Using software tools lets you automate processes at a low cost. Create custom landing pages with Instapage or Webflow. Collect data from your users via Typeform and organize it into a database with Airtable. Set up a simple calendar booking and payment with Calendly. Use MailChimp for marketing automation. And connect the workflows between all these tools with Zapier.

Marketplace builders like Sharetribe can save you a tremendous amount of money and time. You can create a fully functional marketplace with no (or very little) time spent coding or building integrations between multiple tools.

No- and low-code tools are particularly great for non-technical founders who don't have $50K+ to spend on development. But what if you are a developer? Wouldn't building everything from scratch yourself be the best way to cut costs?

In terms of money, possibly, if you don't assign your time a monetary value. But it's still worth it to look at existing software solutions. Building a custom marketplace application from scratch will take months, even from an experienced software developer – which means it will take months before you get to validate your idea properly and move to the next stage.

Your time as a marketplace entrepreneur isn't free. On the contrary, if you don't spend your time on things that benefit your business the most, it has a high opportunity cost: it means the progress of your business will be considerably slower. Headless marketplace software like Sharetribe's self-hosted solution specifically targets developers and makes it easy for them to build a unique marketplace quickly.

Bootstrap marketing means discovering channels that don't require lots of upfront investments. Paid advertising is likely not an option, perhaps some quick marketing testing aside. Instead, you need to figure out a marketplace marketing strategy you can execute on a low budget.

Understanding your marketplace development and funding stages helps you set the right marketing goals.

At first, you're only targeting a small number of people to test your idea. It might be enough to find a target group manually and convince individuals to try your product. If you're targeting stay-at-home parents, you could go to their local meeting with a laptop and some flyers. Someone building a marketplace for connecting personal trainers to customers would head to the local gym.

In the second stage, you're validating your product/market fit. You need to prove you can acquire both supply and demand cost-efficiently. Due to your budget constraints, paid acquisition (from TV advertising to Google ads) is still off the table. Instead, find acquisition strategies where the only investment is your own time.

The best strategies depend on your marketplace type. The way a Business-to-Consumer (B2C) marketplace attracts supply can look a lot like traditional sales. For example, if your providers are restaurants or hairdressers, your acquisition strategy could be to call or visit these businesses and convince them to join. On a Business-to-Business (B2B) marketplace, the entire acquisition strategy can center on direct sales.

For a Consumer-to-Consumer (C2C) marketplace, there's no good way to acquire enough users via direct sales. The same applies to the customer side of B2C marketplaces. In these cases, you need to tap into communities. Be active in various online forums, collaborate with influencers, or create valuable free content that can bring traffic through search engines or social media.

Remember that you don't need huge traffic volumes even in the product/market fit stage. The goal is to get the right kind of traffic. And ensure the people you attract will find what they're looking for on your marketplace.

Mike Williams, the founder of Studiotime, bootstrapped his B2C marketplace (a marketplace connecting artists to music studios) to profitability in 6 months. Here's is how he describes his initial marketing strategy:

"[I utilized] startup launch platforms like Product Hunt, Indie Hackers, and BetaList as well as press and communities specific to my niche, the music industry. I then focused all my efforts into getting visibility within these communities and in the press I knew would reach my target audience. --- All of my first $10k in revenue came through unpaid channels."

No matter how small your initial investment, you still need some capital in the early days. At the very least, you need to have enough money to cover your own cost of living.

If you still have a day job, you might not want to quit yet. Airbnb started as a side hustle and became ramen profitable (i.e., reached the minimum level that sustained the founders financially) much later.

At the same time, you need to invest enough time in your business to move things forward.

In my experience, getting a marketplace business off the ground takes at least 20 hours of work every week. For some, this might be feasible on top of a day job. For others, it might be overwhelming and prevent them from focusing on their business enough.

Working part-time or living off savings can be a possibility, but taking this route means you need to be meticulous about how this impacts your runway.

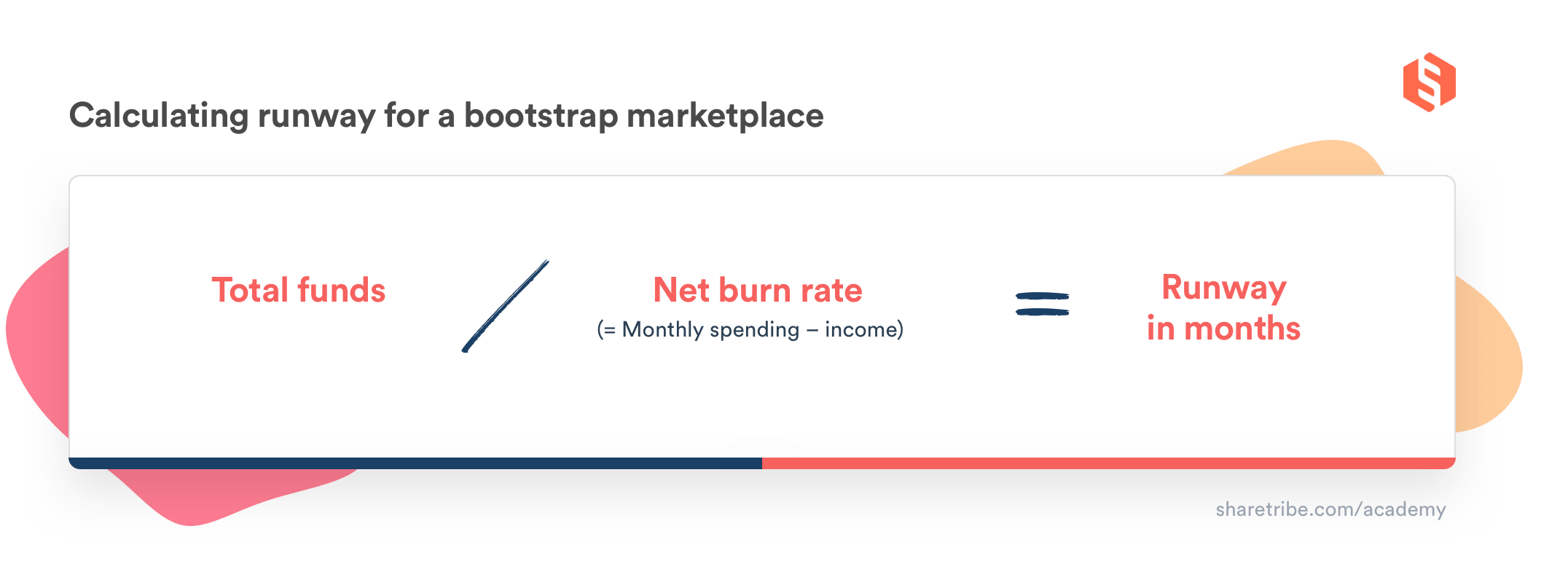

Your marketplace's runway is how long you can sustain yourself if your business doesn't provide any income. You can calculate your runway with a simple formula.

Marketplaces tend to take longer than many other businesses before they reach profitability. Many bootstrapped marketplaces only become ramen profitable after more than 12 months of their inception. I would recommend that if you go all in and leave your day job, 12 months is the minimum runway you should prepare for.

No matter which option you choose, it's a good idea to keep a proper budget to estimate your current funds, expected expenses, and expected income for the coming months.

Until you reach ramen profitability, your marketplace runway is limited. There are three main paths for early revenue available for marketplace businesses:

- Using a subscription model

- Offering manual matchmaking as a service

- Selling unrelated services or products.

If you're building a B2C marketplace, you can often monetize quite early on with a subscription fee model. This is the model Studiotime used: they asked Studios to pay to be listed on their platform. Subscriptions work if the businesses on the supply side are willing to pay for access to your pool of customers.

Sometimes, it's possible to start earning subscription revenue even before launching. Venuu, a marketplace for event spaces, made its first $10k by selling a limited set of heavily discounted memberships to space owners pre-launch. Whether this approach is feasible depends both on your marketplace concept and your sales skills.

Subscriptions can also work if your marketplace offers valuable tools for sellers to manage their business.

For example, Sharetribe's marketplace software has a powerful booking calendar and marketplace payments out of the box. A hairstylist marketplace might start by marketing these tools to potential providers, showing how easily their existing customers can book and pay for online appointments. When a group of hairstylists and customers use the platform, it can be opened as a marketplace to a broader audience.

Turn the lack of automation into a strategic advantage. Connecting customers and providers manually is a powerful way to increase match quality and offer service users will be happy to pay for.

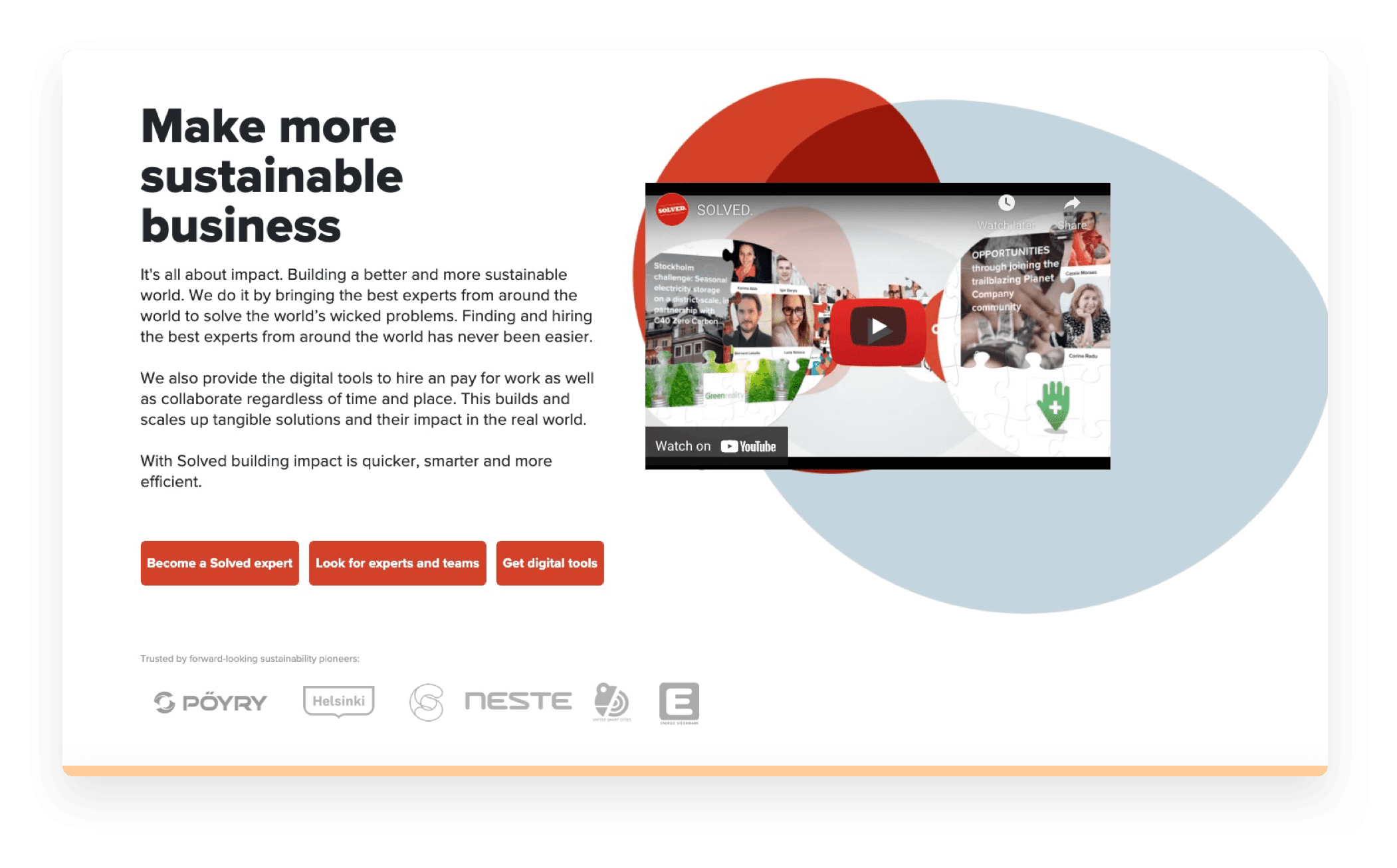

For example, Solved is a marketplace that matches corporations to a network of sustainability experts. But in its early days, Solved earned revenue without any marketplace functionality by operating as a consultancy. They vetted sustainability experts carefully and matched them with customers based on their specific requirements. Later, Solved moved to a marketplace model – though a human touch to matching is still one of their key value propositions.

Solved is a B2B marketplace, and there are a few reasons why the consultancy approach tends to work best in business-to-business markets. In B2B, transactions are large and complicated, so offering to reduce the steps and risks involved is a powerful value proposition. And when each transaction is worth thousands, it's possible to earn enough revenue even with a more labor-intensive manual approach.

Once your consultancy model generates steady revenue, you're in a great position to build tools to automate your processes gradually. Interacting with your users directly also gives you valuable insights to help you make the right decisions in developing your marketplace.

For some marketplace concepts, neither of the options mentioned above is feasible. This is the case for C2C marketplaces in particular.

Customer-to-customer marketplaces typically monetize with a commission model, meaning they take a cut from each transaction. This marketplace business model can be very lucrative in the long run. But if a marketplace relies solely on commission fees, it needs a relatively large user base to reach ramen profitability.

A bootstrapper who needs to earn revenue early is left with one more option: selling products or services that aren’t directly related to the marketplace business.

Selling products can be a scalable strategy for additional revenue if you find the right kind of product. The strategy was made famous by the Airbnb founders, who sold branded boxes of cereal in their early days to cover their costs.

A potentially easier but more limited strategy would be selling your own time as a service. For example, a software engineer or a business expert could spend a part of their time offering consultancy services.

You could also consider selling your time through gig economy marketplaces. You'd be surprised by how many Uber and Lyft drivers are marketplace entrepreneurs in the making! Gig economy platforms don't require you to put in a specific amount of hours, making them a more flexible source of extra income than freelancing. Renting a spare room in Airbnb can be an option as well.

The challenge with taking on gigs is that the earnings are often relatively low. Your cost structure needs to be extremely low, too, to make such an approach financially viable. I wouldn't recommend this approach to someone who has three children.

Bootstrapping a marketplace business requires careful effort. You need to be conscious of your spending and creative in your approach to earning early revenue.

At the same time, the rewards of bootstrapping can be immense. After you've bootstrapped your way to ramen profitability, you get to choose your path freely. You can decide to raise funding or continue running an independent business fully in your control.

No matter what you envision your future path to be, it's likely that you'll spend the first year of your business in bootstrapping mode. If you succeed, you might find yourself faced with several opportunities for funding the next stages of your marketplace.

In the following articles, I'll focus on different external funding sources. First, I'll break down the traditional startup funding route: raising venture capital. I'll discuss what every founder needs to know about the incentives of venture capitalists and cover similar equity-based funding strategies like angel investments. I'll then outline the process of raising venture capital for a marketplace.

Venture capital and angel investments are usually the first startup funding options entrepreneurs consider. However, as you'll find out, VCs have incentives that might be a poor match with what you want to achieve with your marketplace. In the final articles, I'll introduce alternative ways to source external funding for your marketplace: ranging from traditional business loans to newer alternatives like crowdfunding and revenue-based financing.

You might also like...

Why raise venture capital for your marketplace – and why not

Should you raise VC funding for your marketplace? If you want to build a unicorn, yes. If you want to get rich – maybe not.

Marketplace funding: The complete guide

Struggling with funding your marketplace? This guide helps you decide how much marketplace funding you need – and when and where to source it.

How much does it cost to build a marketplace business?

Example of a first year’s marketplace startup budget, and how to spend it wisely.

“Make your marketplace unit economics work,” says Fabrice Grinda

When one of the world’s most successful angel investors talks marketplaces, we listen.

Start your 14-day free trial

Create a marketplace today!

- Launch quickly, without coding

- Extend infinitely

- Scale to any size

No credit card required