How to fund your marketplace without giving up equity

Giving up equity in your marketplace means bringing in external shareholders and their interests. That’s not always desirable. In the final article of the complete guide to marketplace funding, Sharetribe CEO Juho discusses three non-dilutive marketplace funding options: loans, grants, and revenue-based financing.

Published on

Last updated on

In the previous articles of my series on marketplace funding, I've mainly discussed funding options where you need to give up a percentage of your company in exchange for capital. Doing that is not always desirable.

External shareholders might have motivations that differ from yours. Bringing them into your business can sometimes derail your marketplace from your preferred path. Luckily, there are alternatives to equity-based marketplace funding.

In this final article of the series, I'll look at non-dilutive marketplace funding options: loans, grants, and revenue-based financing.

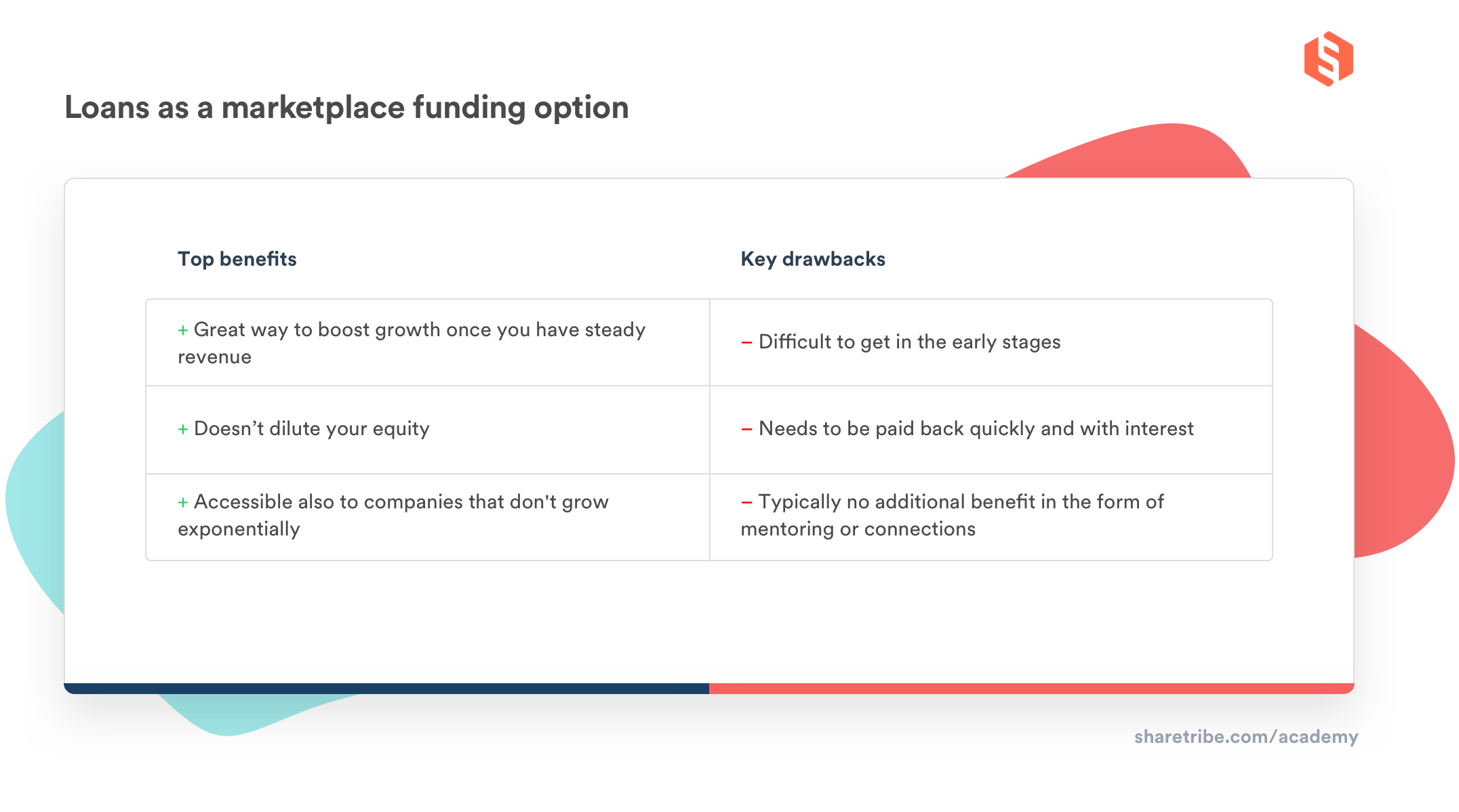

Loans from banks are a traditional way of funding new companies. Lending existed well before venture capital was a thing.

Loans get discussed surprisingly little in the startup world, but they should not be dismissed as a funding option. At Sharetribe, a loan from a local bank was one of our first funding instruments.

The biggest drawback of bank loans is that they are difficult to get in the early stages. Startups are risky, and traditional lenders might not be willing to carry such a risk. Some lenders have loan instruments, particularly for startups. Models called venture debt typically require raising venture capital. The lenders base their assessment of your reliability partially on the reliability of your VC investors. (The words "loan" and "debt" are often used interchangeably, but there are slight differences.)

Another problem is that a loan typically needs to be paid back relatively quickly. The requirement, combined with high interest, might take your company down if your initial growth estimates don’t hold. Therefore, you should only consider a loan when you’re in a stable position to trust your estimates. Once you have reliable revenue, a loan can be a great way to boost your growth without forcing you to give up equity.

In addition to going to banks or more traditional lenders, you could consider peer-to-peer lending through platforms like Prosper. Peer-to-peer lending can sometimes be accessible in situations where a bank loan isn't, and it might offer more attractive interest rates. The biggest drawback is that you need to take personal responsibility for the loan. If your company goes bankrupt, you're responsible for paying back the peer-to-peer lenders.

Compared to angel investors and venture capital, one additional downside of loan funding is that while angels and VCs can provide you with mentoring and contacts, many traditional loan providers (like banks) have little to offer besides the money.

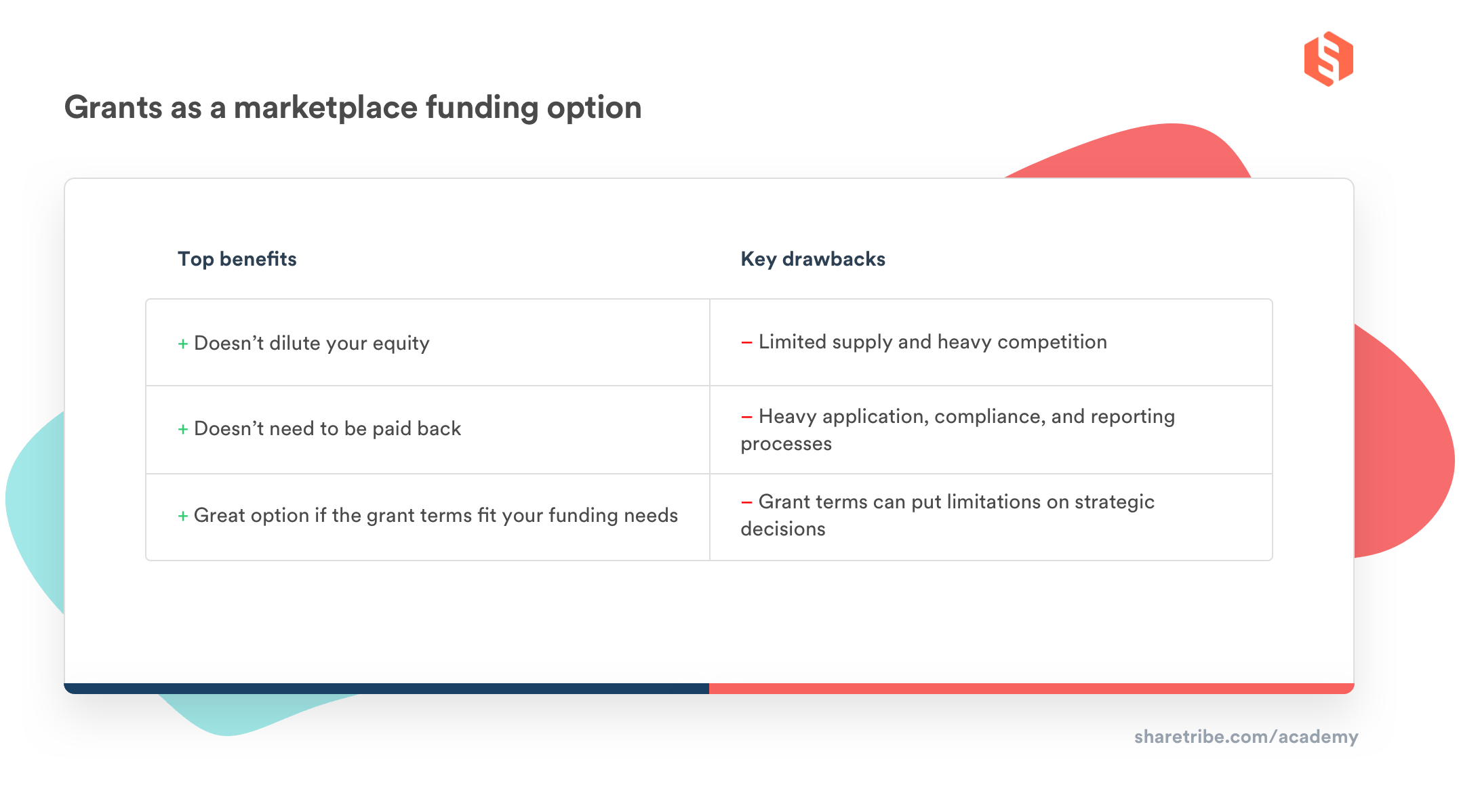

Grants are subsidies provided by governments, public institutions, or organizations like foundations or NGOs. The value proposition is attractive: you don't need to give up equity or pay the grant back.

Grants come with a set of downsides, though. First of all, the supply of grant funding is limited, and there's often lots of competition.

Secondly, the application process can take lots of time and effort and take a long while to provide results. If you're constantly writing grant applications and waiting for results, you might lose focus and momentum.

Third, grants might demand meeting surprisingly heavy compliance and reporting requirements.

And finally, grants often come with a set of limitations that can be detrimental for a startup. For example, say you receive a grant for a specific product development project. Later, you realize you'd have better use for the money in a business development initiative, but the grant terms don’t allow for that. As a result, you might be stuck building (and reporting on) something your business doesn't need.

However, if you come across a grant that fits your marketplace development needs, go for it.

At Sharetribe, we've used grant funding in several forms. When my co-founder Antti and I were just starting out, we received a $30k equity-free grant from Startup Chile, a program run by the government of Chile. The only condition was that one of the founders runs the business from Chile for six months. Since our company works well in a remote setup (and Antti loves traveling), this was an excellent match for us.

Sharetribe has also received grant funding from Business Finland, a government organization that supports innovative Finnish startups. Most countries have a startup grant ecosystem these days, and local experts are the best sources of advice on whether your marketplace is eligible to apply.

Many governments also issue grant funding in the form of tax credits. Seasoned entrepreneur Alex Macdonald has put together a comprehensive guide on tax credit systems in different countries with resources to learn more.

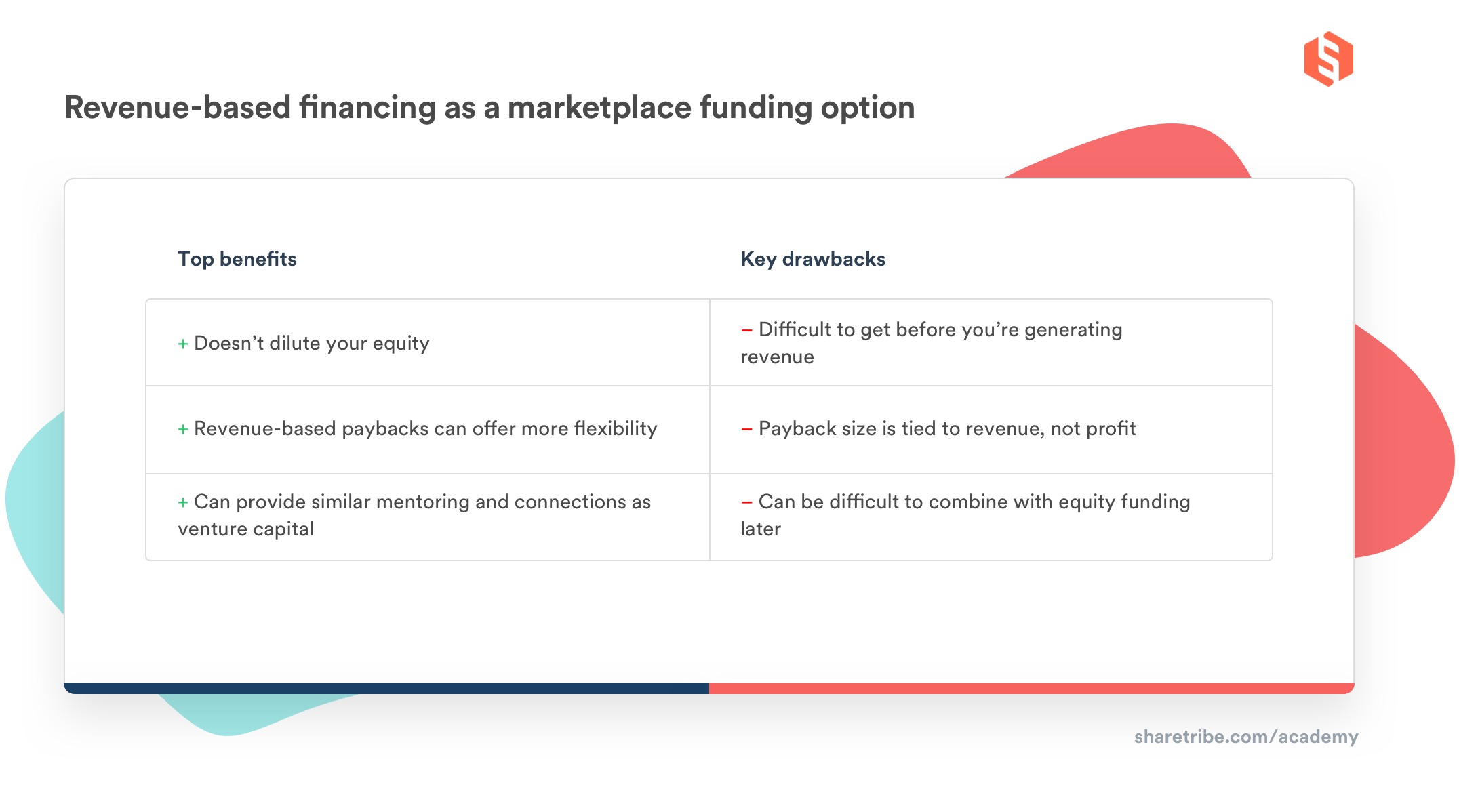

Revenue-based financing is a model where you pay your investors a fixed percentage of your revenues, typically (but not always) until a predefined cap is reached. The model is also sometimes referred to as royalty-based financing.

The model has some similarities to debt but also significant differences.

The biggest difference is that there is no interest in revenue-based financing and no fixed payment. Instead, payments are entirely based on your business performance. If you don't have any revenue, you don't need to pay anything. If your revenue soars, so do payments to the investors.

In addition, many providers of revenue-based financing act more like venture capitalists in the sense that in addition to money, they also provide mentoring and connections. This can be a significant value-add compared to banks which rarely have anything to offer besides the money.

Aligning investor returns with your marketplace revenue can have other important benefits. Many marketplaces operate in markets where business is seasonal. Revenue-based financing could be a more flexible funding option for seasonal marketplaces than a traditional loan. Flexibility can also prove valuable in times of surprising events like the COVID pandemic.

Revenue-based financing can be an attractive equity-free funding option for bootstrappers looking to build a “calm company”. It has also become popular among founders who have challenges getting funded through traditional routes. Studies show the vast majority of venture capital goes to white male founders. Meanwhile, the revenue-based investor Chisos notes that 73% of its portfolio is female or minority founders.

An obvious downside of revenue-based funding is that you need to generate revenue to access it. It's very difficult to find an investor to offer a revenue-based deal to a pre-revenue company. There are exceptions: for example, Chisos offers small amounts of funding to idea- and early-stage founders with high potential.

Another challenge is that generating revenue doesn't mean making a profit. With a revenue-based model, profitability doesn't affect the repayment schedule. Payments to investors might still drag your business down if your revenue grows much faster than your profit.

It would be entirely possible to fix the paybacks on profits instead of revenue. We used such a scheme at Sharetribe with our 2018 equity crowdfunding round by using redeemable non-voting equity: investors got shares in our company, but ones that don't have voting rights. Our shareholders' agreement compels us to spend 40% of our annual profits to redeem these shares at five times the original purchase price.

A profit-sharing model is very friendly to founders. It has higher risks (and higher potential rewards) for the investors, as the returns depend on the company's ability to generate profit. In general, I'm seeing this model used mostly in impact investing and by investors willing to take on more financial risk.

A further potential drawback of revenue-based funding is that it might be difficult to combine with equity financing later. Questions might arise around which party should be paid first and how outstanding paybacks should affect the valuation of the company. Some funding structures, like the Calm Company Fund Shared Earnings Agreement and Chisos Income Share Agreement, state that in the event of an equity fundraise, their investment is converted into equity.

It's also good to keep in mind that revenue-based funding is typically more expensive than traditional loan funding. Revenue-based investors are willing to take more risk than banks, and as a result, they typically expect a higher return too.

This article barely scratches the surface of the rich landscape of non-dilutive marketplace funding options. If you're interested in learning more, here's a list of resources to get you started.

Further reading on non-dilutive funding:

- Aunnie Patton Power's book Adventure Finance is a comprehensive guide to non-dilutive funding options. It’s a fantastic resource I highly recommend for anyone considering this funding route.

- Esme Verity offers an educational program for founders interested in alternative financing through her Considered Capital brand and related newsletter.

If you have a bootstrapped marketplace company that generates revenue, here are some revenue-based investors you could consider. Some of them focus on impact-oriented companies specifically, while others focus on female or minority founders. Some are happy to work with any financially sustainable businesses.

- Purpose Ventures

- Calm Company Fund

- Chisos

- TinySeed

- Village Capital Investments

- Lighter Capital

- Candide Group

- Deetken Impact

- Collab Capital

- Novel Capital

- The funding directory put together by Esme Verity in The Considered Directory

- More examples are listed in a comprehensive resource put together by Alex Macdonald and in Aunnie Patton Power's book.

Equity-based financing is not for every marketplace. In this article, I've taken an overview of non-dilutive funding options and discussed their pros and cons. While no funding option is perfect for everyone, the main takeaway from this article is that there's a vast number of creative financing options available today for marketplace founders. No matter which you choose, it's a good idea to spend some time to understand the entire landscape.

This article concludes my series on marketplace funding. In the previous posts, I've discussed marketplace bootstrapping, whether raising venture capital is a good idea and how to raise VC for a marketplace, and marketplace equity crowdfunding.

You can stay tuned for more marketplace advice by subscribing to Marketplace Academy.

You might also like...

Marketplace funding: The complete guide

Struggling with funding your marketplace? This guide helps you decide how much marketplace funding you need – and when and where to source it.

How to bootstrap your marketplace

Can you build a successful marketplace business without funding? Absolutely! Bootstrapping might even help you become profitable faster.

Vacate the VCs – An interview with Jeremiah Owyang

Advice on alternative ways to fund your marketplace startup.

Start your 14-day free trial

Create a marketplace today!

- Launch quickly, without coding

- Extend infinitely

- Scale to any size

No credit card required