Marketplace funding: The complete guide

How much funding does a successful marketplace need, and what is the best funding source? The short answer is: it depends. Read on for the long answer from Sharetribe’s CEO Juho Makkonen.

Published on

Last updated on

"How should I fund my marketplace business?"

"How much funding do I need?"

"What’s the best source for marketplace funding?"

The short, unsatisfying answer to all these questions is: "it depends". Every marketplace business is different, and so is the optimal funding strategy.

This article series will give you a longer, more actionable answer. My goal is to help you make the right funding decision for you – not just for your current startup stage, but for your entire business journey.

In a series of six posts, I attempt to give a full picture of the marketplace funding landscape: what kind of marketplace funding options are available for marketplaces in different stages, what the strategies are for pursuing them, and how a marketplace entrepreneur can determine a funding path that is right for them.

When I use the word "funding", I mean the capital investment that gets the marketplace business to a state where it can fund itself with its revenue. Some marketplaces reach this state faster than others. In this first post, I'll discuss:

- Whether you need funding in the first place.

- The three stages of marketplace development and funding.

- How to determine how much funding you need in each stage.

- What marketplace funding options are available.

In the following posts, I'll dive deeper into three different funding paths: bootstrapping a marketplace business, venture capital and angel investors, and alternative funding sources, like marketplace crowdfunding and non-dilutive marketplace funding options.

How much funding your marketplace needs boils down to two big questions:

- What is your end goal with your marketplace idea?

- What milestones do you need to reach to get to your goal?

The answers to these questions depend on the kind of business you’re building. But they also depend on who you are as a person, and what you want out of life. Do you prefer to take big risks or play it safe? How would you like to spend your workdays? What motivates you? What do you want to achieve in life, and why?

So, instead of asking how much funding successful marketplace businesses raise in general, try to determine how much money your unique business needs.

Most marketplace businesses require at least some funding before they start earning revenue. But in many cases, the initial budget can be very low.

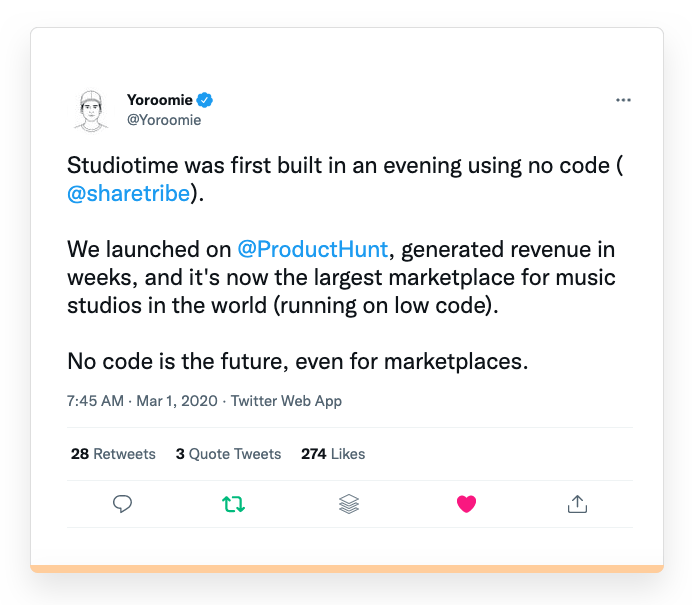

I have seen marketplaces reach profitability after investing just hundreds or thousands of dollars upfront. Our customer Mike Williams built Studiotime in a single day, launched it on ProductHunt, and started generating revenue in a matter of weeks.

Meanwhile, other marketplace concepts might call for multiple financing rounds of millions of dollars before reaching profitability. If they ever do. Uber, one of the most well-known marketplace companies, has never posted a profitable quarter since being founded in 2009. Even so, the company is currently valued at nearly $100 billion.

I suggest that you start your marketplace journey from the end goal. Why are you building this business? Is your goal to build the next startup unicorn, like Airbnb and Uber? Are you looking to make a positive impact in the world? Are you hoping to get rich? Or is your plan to build a small to medium-sized business that provides a comfortable lifestyle for you and perhaps for a small team?

Once you have the answers to these big questions, you can map your personal goals to the nature of your business to see if they match.

Then, you can start planning for the milestones you need to reach in the journey towards your goal.

Once you've figured out your end goal, it's time to think backward from it. What are the different steps you will take to reach your goal? And how much funding do you need in each stage?

For example, if your goal is to build a unicorn business, you need to target a market that is worth billions of dollars. Such markets often face heavy competition from well-funded startups. To beat the competition, you might need a lot of funding early on. Meanwhile, if you're looking to build an independent small to medium size business where you retain control of the company, your funding strategy might be quite different.

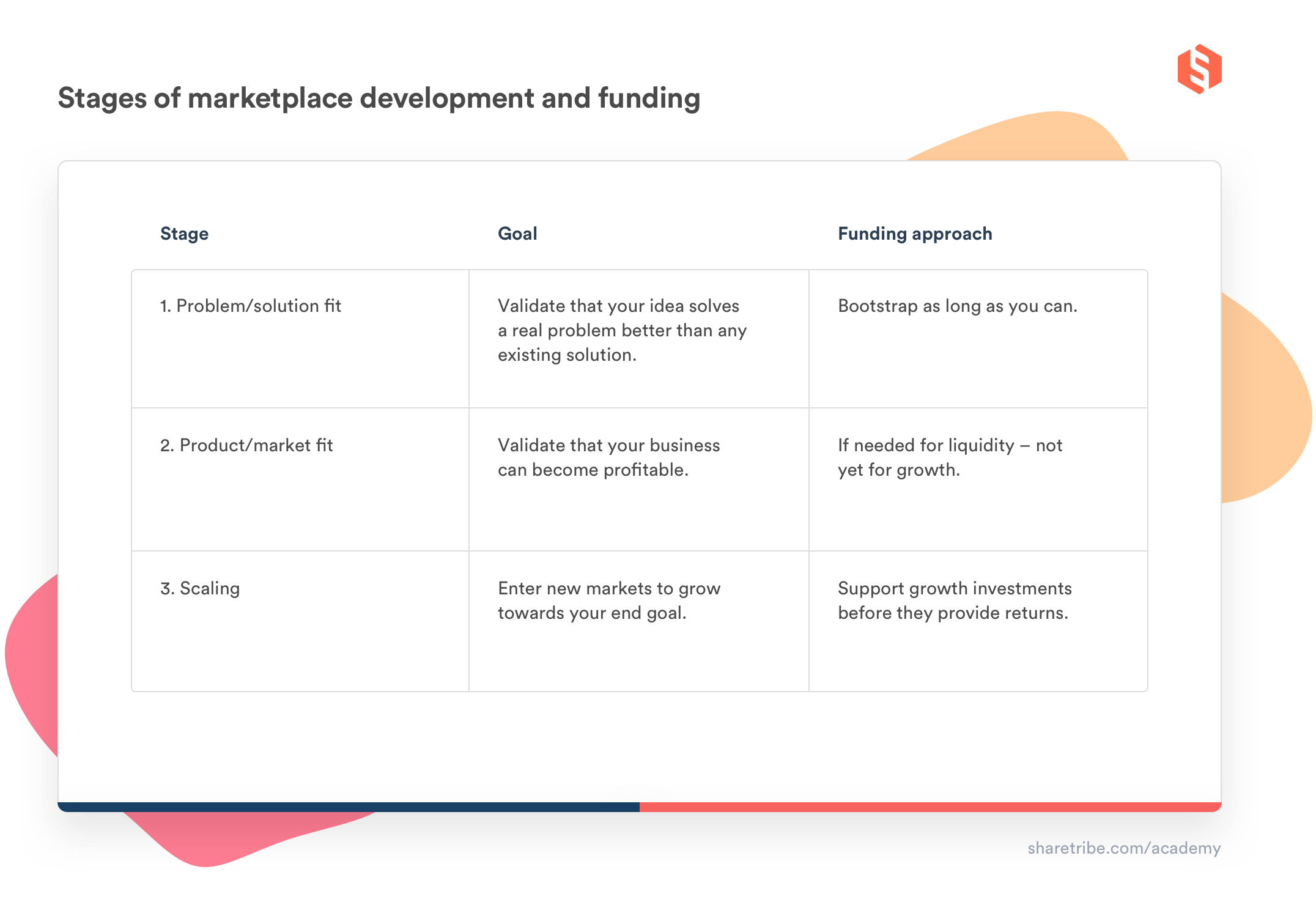

This isn’t to say all marketplaces would grow and develop through completely unique paths. In fact, quite the opposite. In my experience, almost every successful marketplace has developed through three stages:

- Problem/solution fit

- Product/market fit

- Scaling.

I recommend you think about your journey in this three-step approach as well. I’ll explain why in the following chapter, and also show how understanding the three stages helps you make better funding decisions for your business.

When you launch a marketplace, your very first goal is to validate that it solves a real problem for users better than any existing solution. To do that, you need to find at least a small group of users on both the demand side (customers) and supply side (providers) of your marketplace. Once you do, you have reached problem/solution fit.

The funding you raise at this stage should be the very minimum you need to reach problem/solution fit and move on to the next stage: product/market fit.

In the product/market fit stage, you need to validate that there's a big enough market for your solution. You need to prove you can solve your users’ problem in such a way that your costs are lower than what users pay you. This equation is called unit economics. If your unit economics don’t work, your marketplace won’t reach any meaningful scale.

Once you've proven that this core equation (customer lifetime value - customer acquisition cost) is positive in your initial market, you're ready to move on to the next stage: scaling.

Scaling will look different for every business. In this stage, you start finding new markets where you can repeat your product/market fit playbook. If you started in one city, you'll open up more cities. If you started in a small country, you might go international. Or you might expand into new verticals and add more product or service categories.

The third stage is where marketplaces’ funding requirements differ the most. But even in the early days, your strategic decisions can make a big difference in how much funding you need and how you can raise it. Let’s look more closely at funding the three stages.

Try to bring your marketplace to problem/solution fit with as little funding as possible.

Sometimes, the only investment you need at this stage is some of your time. If your idea is about matching supply and demand in a fragmented offline market, a landing page and email might be enough to validate it. In fact, matching supply and demand manually can help you learn about your audience and offer a high-quality experience.

Other cases might call for a more complex Minimum Viable Platform. If your supply side has an online presence in Shopify, you probably need to match some of Shopify’s discovery and payment features to offer a viable alternative. But even in this scenario, the upfront investment doesn’t have to be big. Software tools like Sharetribe let anyone create a relatively complex marketplace without coding and for a cost in the range of $100–$300 per month.

There are situations where you need a unique marketplace application from the get-go. For example, if your business idea is to disrupt an incumbent marketplace by offering a better workflow or matching algorithm. You should still validate your marketplace idea before you start developing, but in the end, solving a problem better than the competition requires a digital platform with unique features.

Building a custom marketplace is a big investment, but there are ways to limit the need for funding. Determine which parts of your solution are unique and which features you can outsource to existing software. Sharetribe, for example, can greatly reduce the cost of building custom marketplaces. It offers you all basic marketplace functionality out of the box, without any coding. You can launch your marketplace in a matter of days. Later, when you're ready to invest more in custom development, you can extend Sharetribe's functionality with coding. But your developers still only need to code the features that are unique to your idea. A marketplace that might cost more than $100k to build from scratch might be achievable for $10k–$20k using Sharetribe.

Ideally, you don't need to raise any external funding to reach problem/solution fit. Fundraising is time-consuming, and raising funding too early can distract you from your end goal. In addition, many business ideas don't survive this first stage. External funding that comes with strings attached might limit your ability to change directions quickly.

In the product/market fit stage, you’ll validate that your business can be profitable.

Your key marketplace metric in this stage is liquidity. Liquidity measures how efficiently your marketplace matches supply and demand. Another sign of product/market fit is measured by repeat purchase ratio: what portion of your customers return for a second purchase.

In the product/market fit stage, you can no longer do everything manually.

Instead, you need to create technology to automate core processes and remove the costs of manual labor. This typically means you need to invest in custom marketplace development. Most of our customers transition to a self-hosted version of Sharetribe at this stage to continue iterating on their platform and building unique features without having to rebuild everything from scratch.

Product/market fit is the stage where some marketplaces need additional funding to reach the next stage. The two main uses for that funding are product development and attracting enough demand and supply.

If you raise funding, a word of warning: Don’t focus on scaling your business as fast as you can. Not yet. Keep focus on your initial vertical and marketing investments to a minimum.

Keeping your foot off the gas pedal can be difficult if you've raised capital from angel investors or venture capitalists. Many investors (especially those who aren't experienced in marketplace dynamics) tend to encourage entrepreneurs to grow fast. When I talk to successful marketplace entrepreneurs, almost all of them say their biggest mistake was attempting to scale prematurely due to push from investors. And for every successful entrepreneur, nine failed because they ran out of money scaling a business that wasn’t ready.

To avoid this fate, explain to investors upfront what you're planning to do with their investment and what your target metrics are. For example, that in the next 12 months, you want to prove you can reach a provider liquidity of 50% (half of the available inventory is purchased) with customer liquidity of at least 20% and repeat purchase rate of 30%.

When it’s time to start scaling your marketplace, your end goal should play a big role in your funding decision.

If your goal is to build a sustainable, profitable business that is fully in your control, you might continue without external funding. Instead, you could strive to reach full profitability: in addition to customer acquisition costs, your revenue should also cover costs like R&D and administrative costs. Perhaps you'll be satisfied with being the biggest player in your core market, and decide not to expand into other markets at all. Alternatively, you could enter new markets slowly and carefully to ensure you can fund your operations from your cash reserves.

Meanwhile, if you are after a big market and desire to build a unicorn, this might be the right time to raise a significant round of venture capital.

If you have discovered a great concept in a big market, it's likely that you already have strong competition. In such a situation, conquering enough markets before your competitors do is crucial. Being first to market allows you to benefit from network effects, which make your business defensible against new entrants.

In some marketplace concepts, significant upfront investment is required to enter new markets. Location-based services like food delivery or mobility are great examples. Such marketplaces usually need big investments in each new market before these markets become profitable. Once they do, network effects kick in.

For example, our customer Drive lah quickly grew into the biggest car-sharing marketplace in their initial market in Singapore. To be able to repeat the success in new markets, the founders decided to raise a significant amount of funding.

Other marketplace concepts can be significantly more cost-efficient to scale to new markets. Virtual services, for example, require much less infrastructure on location than peer-to-peer car sharing.

Even so, significant upfront investments might be required eventually. Consider customer acquisition. It might cost you $100 on average to acquire a new customer, with the customer average lifetime of 12 months and value of $200. Your unit economics are working, but if you want to acquire 1,000 new customers, you need to pay $100k right away and wait 12 months to get your returns. This means your cash reserves have a big impact on your ability to use this growth strategy, and external funding could dramatically speed up your growth.

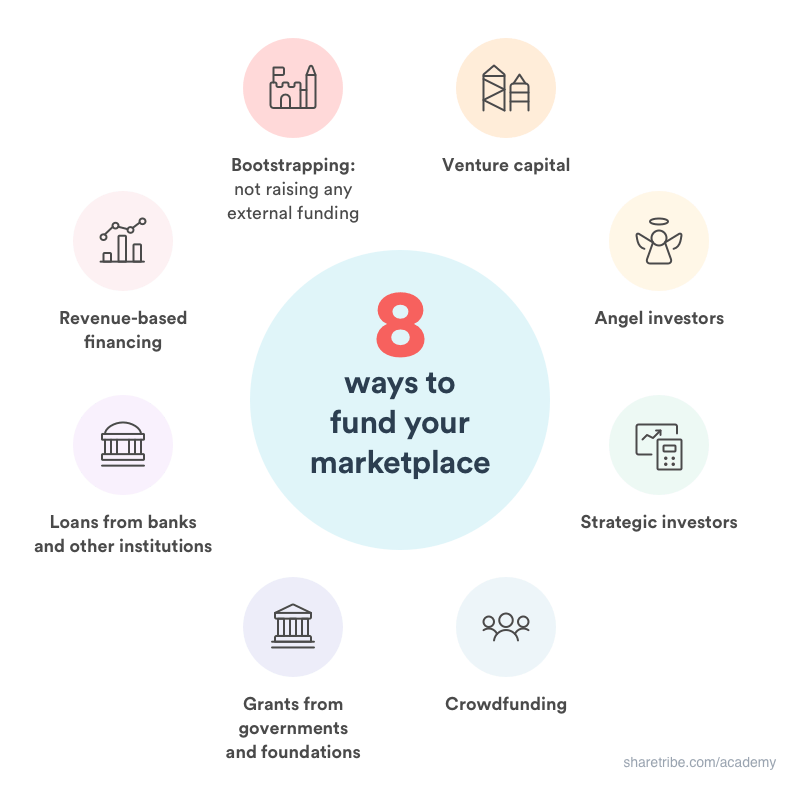

Generally speaking, there are eight different ways to fund a marketplace startup:

- Bootstrapping: not raising any external funding

- Venture capital

- Angel investors

- Strategic investors

- Crowdfunding

- Grants from governments and foundations

- Loans from banks and other institutions

- Revenue-based financing

In most articles that discuss startup funding, the focus is on marketplace venture capital and angel investors. They are indeed an important potential source of funding. But there are plenty of other funding alternatives as well.

Potential funding sources include big companies investing their own money, governments or foundations offering grants, banks or other institutions offering loans, and funds that work with revenue-based financing models. In addition to big institutions, you can also consider pooling funding from individuals by using crowdfunding in its various forms.

As an aspiring entrepreneur, you should consider all these options and their applicability to your specific situation. All of them have pros and cons, which you should evaluate carefully before choosing your approach. Some funding sources are also better suited in some stages than others, so you might want to combine some or all of the approaches in the course of your journey.

Every marketplace and founder is different, and so is the ideal funding strategy. But startups tend to evolve through three stages, first from problem/solution fit to product/market fit, and then to the scaling stage.

Knowing the stages and setting the right milestones towards your unique end goal helps you find an optimal marketplace funding approach.

As you’ll see in the following articles of this series, different funding alternatives are best suited for different goals. Choosing the right one can give you exactly the boost you need. The wrong one might hold you back or lead you in the wrong direction.

My goal for the article series is to help you choose the right funding strategy for your entire business journey. In the next articles, I'm going to take a deeper look at the pros, cons, and tactics of four different marketplace funding approaches: self-funding or bootstrapping, venture capital and angel investors (I'll look at why you should and shouldn't consider VC as well as the tactics to raise venture funding for your marketplace), crowdfunding, and non-dilutive funding (loans, grants, and revenue-based financing). Make sure you won’t miss the next article and sign up to Marketplace Academy.

You might also like...

How to bootstrap your marketplace

Can you build a successful marketplace business without funding? Absolutely! Bootstrapping might even help you become profitable faster.

How much does it cost to build a marketplace business?

Example of a first year’s marketplace startup budget, and how to spend it wisely.

Your marketplace MVP – How to build a Minimum Viable Platform

What you should focus on when you’re creating the first version of your marketplace platform.

How I built a bootstrap marketplace

Mike Williams discussed building and scaling Studiotime all without external funding. Before Mike sold the business, Studiotime was the largest online marketplace for booking music studios.

Start your 14-day free trial

Create a marketplace today!

- Launch quickly, without coding

- Extend infinitely

- Scale to any size

No credit card required