Insurance: The Next Frontier for Online Peer-to-Peer Marketplaces

This is the first in a series of research articles that discuss the state of insurance for online marketplaces, to help you understand why insurance is challenging and what options are open to you.

Published on

Last updated on

The sharing economy is becoming mainstream. This growth has been fueled by technology platforms—like Airbnb, Uber, and BlaBlaCar—that are connecting demand with spare capacity. This new economy has grown enormously in the last five years: a 2016 report by PwC estimates that peer-to-peer platforms generated €4 billion of revenue and facilitated €28 billion worth of transactions in 2015. PwC forecasts that global revenue could reach $335 billion by 2025.

Insurance is a critical topic online peer-to-peer marketplaces will need to consider to benefit from these growth projections. Insurance is required to reinforce trust and win over risk-averse users. We will be publishing a series of articles on the subject to help you understand why insurance is so challenging and what options are open to you. Our first article should give you an overview of the insurance field as it relates to the sharing economy—an industry where the rules are still being written.

Nightmare scenarios aren’t unheard of in the sharing economy. For smaller platforms, any major mishap and the associated trust breach may be difficult to recover from. There have already been high-profile cases of Airbnb landlords finding their homes trashed and Uber drivers being involved in cases of serious misconduct. In this context, many potential customers maintain reservations and concerns about safety in the sharing economy. A 2015 PwC report noted that, among those who had tried sharing in the US, 57% said: “I am intrigued by companies in the sharing economy but have some concerns about them.” In the UK, 75% of sharing economy users consider insurance to be important when using said services. Unsurprisingly, the CEO of a car-sharing company quoted in the PWC report acknowledged insurance as the “biggest challenge” in the sharing economy.

People generally don’t understand the risks when engaging with a peer-to-peer platform. Users are often uninsured or underinsured. Standard insurance policies are usually not fit for occasional sharing practices. In addition, sharing economy marketplaces struggle to obtain insurance for themselves or their users because they do not have an “insurable interest”, i.e. they don’t own any inventory that can be insured. Clearly, the sharing economy presents an exciting opportunity for insurance and peer-to-peer platforms alike.

When the sharing economy first came into being, appropriate insurance did not exist. The platforms relied solely on trust between users. While trust remains critical, the sharing economy comes with a unique set of risks which drive demand for new, innovative insurance solutions. Some sharing economy businesses are responding by offering guarantees or providing access to an insurance product. “Insurance gaps”, however, still remain. Sharers have few contractual protections and are, to a large degree, reliant on the good faith of the platform. It is unclear what a platform's duty of care is to their users.

As an entrepreneur, you need to start thinking about your responsibilities and risks. You need to think creatively about the most appropriate solutions for your end users. Being proactive in offering insurance products is critical in safeguarding your reputation and can open up new revenue streams. Generally, the insurance industry is moving towards on-demand and bespoke insurance (smartphone-friendly claims management, smart contracts, etc.) and entrepreneurs can benefit from these innovations.

“New digital ecosystems will force insurers to re-examine how they conduct their businesses in the new sharing economy” - Micheal Lyman, Senior Managing Director of Accenture Insurance

With an industry that has been very slow to offer specialist coverage, the only real option for startups has been to launch and hope for the best, with the expectation that once enough data is collected, proper insurance solutions will be developed.

In the retail insurance space, consumers are more connected than ever via a multitude of devices and platforms. Almost 80% of insurance customers want personalised and just-in-time insurance. On the one hand, customers are frustrated with the clunky buying process and expect a smarter service. On the other, a growing proportion of consumers is made up of millennials. They are not interested in annual policies which might cover them for unrealistic risks. They want insurance products designed on a modular basis, ones that allow them to only purchase the cover they need.

Insurtech can be defined as the result of the extensive use of technology in the insurance sector, giving rise to new innovative products and services. Insurtech is often considered a part of Fintech (technology applied to the financial services sector), with both of them sharing the same underlying transformational ideas and collaborative ethos. Disruptive startups have knocked down some of the main barriers to entry while focusing on user experience, an area the insurance sector has traditionally struggled with.

Insurtech leverages technologies like big data to make use of numerous consumer data streams and blockchain to get rid of intermediary parties. As the UK Financial Conduct Authority (FCA) has stated, technology represents a major opportunity “to transform how consumers deal with insurance firms, allowing firms to develop new products as well as reducing form-filling, streamlining sales and claims processes”. It also allow insurers to price risk more accurately. The “Insurance 2.0: Insuring the Sharing Economy & Sharing the Insurance Economy” White Paper, prepared for the US Casualty Actuarial Society, concluded:

“We believe this peer-to-peer trend will continue and could culminate in true peer-to-peer insurance, or risk transfer between individuals, with regulators constantly playing catch up and insurers either adapting or being displaced.”

In the startup world, Insurtech is currently one of the most dynamic and exciting sectors. According to a KPMG report, Insurtech attracted $2.5 billion in VC investment last year, a big funding hike compared to the previous four years. According to Gartner, 64% of the world's Top 25 insurers have already invested in an InsurTech startup. Moreover, around 72% of insurance executives are planning, or have already established, new distribution partnerships to embrace the opportunities of the sharing economy.

The Insurtech ecosystem includes:

- Startups are the most disruptive players on the insurance scene. They are generating new business models based on peer-to-peer insurance, usage-based insurance, or consumer platforms which aim to improve customer experience.

- Technological giants such as Facebook, Google or Apple are entering the insurance sector. Their huge volume of personal data allows them to offer more customizable insurance plans. Other players include companies that make innovative use of mobility, such as Tesla with its new “Insure my Tesla” program.

- Traditional insurers who are rethinking their strategy in this new competitive landscape in four ways: collaboration (Axa/BlaBlaCar in Europe, Lyft/MetLife in US and Zurich/Uber in the Asia-Pacific region), partnership (AXA and Alibaba), VC investment (Munich Re invested in Slice Labs), and startup incubation (Allianz launched Allianz X InsurTech incubator).

The legality of many sharing activities is ambiguous. Issues remain around tax liability, regulatory compliance, and the contractual relationship between consumers, users, and the platforms that facilitate sharing. As a result, it is unclear which party is liable and therefore requires appropriate protection. This is further complicated by jurisdictional challenges—the platforms are usually based in one country but provide their service to consumers and service providers in multiple countries. There is a lack of harmonization between jurisdictions and regulatory frameworks, which makes compliance with the law costly and time-consuming, and restricts business growth despite consumer demand.

Many insurers do not have the geographical reach to cover these cross-border risks. Commercial liability policies issued to the platform may be inappropriate to cover risks associated with the users of the platform, therefore requiring policies to be issued to every individual user in each jurisdiction. As a result, traditional insurers often have a limited appetite for the cost and complexity involved in providing appropriate insurance solutions for sharing economy platforms. Nevertheless, the insurance industry has a significant incentive to address these challenges. From a pure technical perspective, many collaborative activities are relatively easy to insure as the industry has been insuring these type of risks for many years. The greatest challenge lies in developing effective digital distribution models that are appropriate for the collaborative economy.

As we have discussed, the insurance landscape for peer-to-peer platforms provides new challenges which require thinking outside the box. It is a landscape ripe with opportunity for entrepreneurs to innovate and add value to their users. There are a few considerations to keep in mind:

- Some entrepreneurs may consider providing their own insurance solutions directly to their users, either as part of the platform fee or purchased separately. However, to sell insurance in the EU, one needs to be an authorised agent, intermediary, or insurance company in all markets. The requirements for such authorisation vary by market, but are usually significant and overseen by the financial services regulator. Practically speaking, it is not cost effective for a non-insurance business to obtain such authorisation.

- For sharing platforms, lack of an “insurable interest” in the property, goods, or services that are offered makes obtaining insurance difficult. The platform may, however, purchase insurance that covers their legal liability for damage or injury to the users of the platform. It may also be possible to extend this liability insurance to cover the end users of the platform.

- In some markets, platforms could be allowed to act as a distribution outlet, referring or directing users to an authorised insurer or agent. In this case, the contract would be between the individual and the insurance company, not the platform.

In the US, regulators have been more proactive than the insurance industry�—and, indeed, EU regulators—in addressing sharing economy coverage gaps. Dave Jones, the California Insurance Commissioner, has been active in making sure that the sharing economy industry takes appropriate responsibility and that the insurance market responds with relevant products.

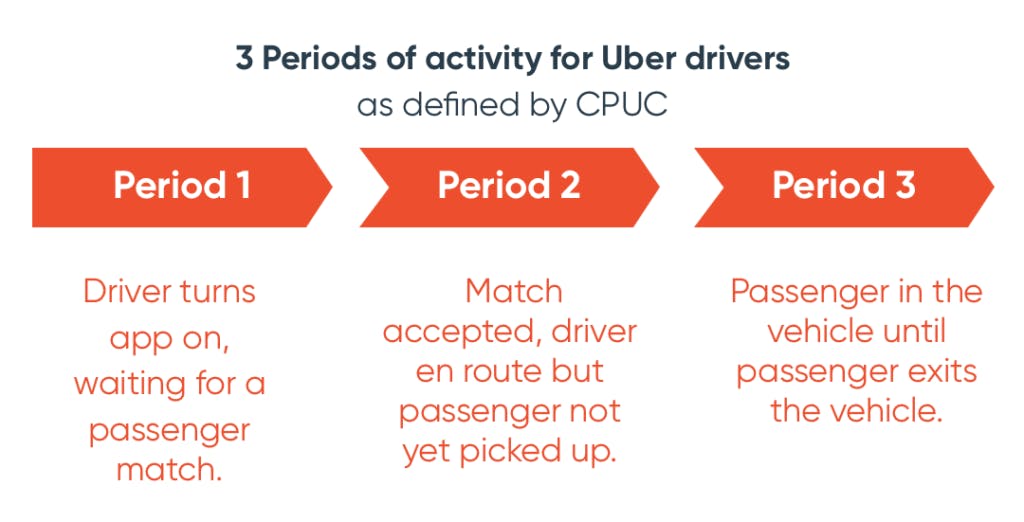

In September 2013, the California Public Utilities Commission (CPUC) passed a law naming ridesharing companies as ‘Transportation Network Companies’ (TNC) and instructing all drivers operating in California to carry $1 million commercial liability insurance. However, at that time, no guidance was given on when the personal coverage should be replaced by commercial coverage. The ambiguity of coverage became apparent on 31st December 2013 when Muzaffer, a 57-year-old Uber driver, killed six-year-old Sophia Liu in San Francisco. The driver was not carrying a passenger, nor responding to a passenger request, but did have the Uber app turned on. Uber and the driver’s insurer denied liability. The CPUC was mandated to devise a solution for the insurance, which led to the formulation of three periods:

From July 2015, the law requires ride-sharing companies to provide insurance coverage in Period 1 to cover cases like Sophia Liu’s. In January 2015, the Commissioner had announced approval of a new insurance endorsement for UberX drivers that have their vehicles insured by Metromile (a usage-based Insurance) to obtain period 1 coverage.

On the home-sharing regulatory front, San Francisco passed a law In October 2014 which came into force in February 2015 legalizing property rentals for less than 90 days for city residents renting out their property. This law required home-sharing platforms to collect hotel taxes on behalf of guests and provision at least $500k in liability insurance coverage.

Likewise, New York lawmakers picked up on the potential insurance gap problem presented by the Airbnb Host Guarantee Policy that was launched in early 2012. The Host Guarantee Policy provided a $1 million limit, but only covers deliberate property damage by a guest, is applied in excess of any primary policy, and only after seeking and failing to recover damages from the guest. It also needs to be reported within 14 days. The State Superintendent investigated, and in November 2014, Airbnb announced the introduction of a Host Protection Insurance—effective 15th January 2015—which will automatically provide $1 million liability coverage to hosts within the U.S. in excess of their primary coverage.

In June 2016, the European Commission published “A European agenda for the collaborative economy” which was very supportive of the sharing economy sector. Interestingly, the Commission differentiated between digital platforms whose activity is mainly “technical, automatic and passive” and those, like Uber and Airbnb, which offer not only hosting services but also rating facilities, payment facilities, insurance, or ID verification. In such cases, the Commission argues, the liability of digital platforms should be bigger. It did not, however, provide recommendations or guidance for how individual countries should regulate this sector.

In this context, the EU could find itself lacking the right legal tools to protect users. Consumer protection regulations only apply to company-to-consumer relations, not peer-to-peer relations. In order to promote a safe environment for users, BEUC, the EU consumer association, argues that “platforms need to have insurance in place, or provide adequate insurance policies where necessary”. The Commission said it will monitor the evolution of this nascent sector, collect statistical data and evidence, and support the exchange of best practices. The EU did not rule out the possibility to come up with new legislative proposals if regulatory gaps remain.

Insurtech still faces legal uncertainty, especially with regards to new entrants that are disrupting a highly regulated sector. The EU’s efforts to regulate financial markets has, however, opened up new opportunities. Insurtechs need to take into account several regulations, mostly related to online issues such as data protection regulation and online consumers protection. Determining the concrete nature of the agent—i.e. whether a company becomes an insurance company, an insurance broker, a marketplace, an aggregator, etc,—has particular relevance in Insurtech as it obviously has an impact on the applicable regulatory framework.

This uncertain landscape may be about to change. Gabriel Bernardino, the chair of the European Insurance & Occupational Pensions Authority (EIOPA), said at a recent conference:

“The change coming from the digital era is different: […] it is not incremental; it is disruptive. The entire insurance value chain will be impacted […] big data and telematics, comparison websites and automated advice tools will impact the interface with consumers. The increasing amount of personal data available and the power of data analytics will inevitably change insurance underwriting models […]“

Starting in 2017, EIOPA will organize a series of roundtables to understand the challenges ahead for Insurtech. EIOPA will draw on these roundtable discussions as it tries to develop Europe’s regulatory framework in a way that will “promote the highest standards of consumer protection while not hindering innovation“.

In 2014, The UK Department for Business, Innovation & Skills commissioned a groundbreaking report on the Sharing Economy called “Unlocking the Sharing Economy: An independent review”. The review states that “insurance is crucial to making the sharing economy work for everyone”. It urged Member States and the Commission to investigate EU-wide cooperation with the insurance industry to ensure sharing economy services providers have access to insurance and to clarify questions of liability. The review added that when it comes to insurance, sharing economy businesses represent a market in itself, meaning they should pool resources to create a trade body to negotiate insurance coverage. While sharing economy platforms are interested in offering bespoke insurance products, engagement with insurers and brokers is still not common. This is why the UK Government approached the British Insurance Brokers’ Association (BIBA) to find brokers who could design innovative solutions. A number of BIBA brokers offering products specifically for the sharing economy are now listed on their website.

On another trailblazing development, the trade body Sharing Economy UK was established in 2015. The first kitemark scheme, known as ‘TrustSeal’, was launched a year later. It was created for sharing economy platforms to promote consumer trust. A governance and advisory panel of industry experts, including BIBA, will award TrustSeal accreditation to companies who show compliance with TrustSeal’s eight Good Practice Principles. They include, among others, providing information on insurance and guarantees to users.

Debbie Wosskow, founding chair of Sharing Economy UK, stated:

“Insurance plays a fundamental part in the sharing economy as it can help consumers to feel safe and protected when using relatively new services and businesses. Through working with BIBA we’ve taken significant steps forward towards making sure that the sector collaborates with sharing economy companies of all shapes and size and we will continue to push this forward. We’re excited about the rate of change and are looking forward to continue to make progress, and stamp exemplar insurance companies with the TrustSeal of approval.”

In this series of articles about insurance and the sharing economy, we have started with some background to communicate the sheer complexity of this infant sector which is still in a state of flux. Trust is a fundamental pillar of the sharing economy, but it is becoming increasingly apparent that trust needs to be reinforced with an additional layer of insurance. Indeed, in the opinion of many thought leaders, insurance represents the next frontier for the sharing economy. Getting it right will be critical for reaching a wider number of reluctant but potential users who still believe peer-to peer-sharing involves too many risks.

Insurance and the sharing economy are creating opportunities for the insurance industry and entrepreneurs alike. An exciting ecosystem of traditional insurers, technological companies and Insurtech startups has emerged, ready to provide innovative solutions to the market. Entrepreneurs need to start thinking about their risks and responsibilities and come up with the most appropriate solutions for their users. There is an opportunity for entrepreneurs to gain a competitive advantage, enhance their reputation, and generate new revenue streams. At the same time, the insurance industry is moving towards on-demand and bespoke insurance, which can be great for entrepreneurs.

While complexity and ambiguity prevail on the regulatory front, regulators in the US have been more proactive in addressing sharing economy coverage gaps than in the EU, where the institutions have not put forward any legislative proposals and are merely monitoring the market. The UK is a salient example of sharing economy and insurance thought leadership: the Government has invited the national brokers’ association to design solutions for sharing platforms and the sharing economy trade body has launched a landmark trust kitemark scheme for platforms.

We will be monitoring the market and reporting relevant developments and opportunities on the Marketplace Academy. Read the second article in this series.

Keep Reading

Insurance: The Next Frontier for Online Peer-to-Peer Marketplaces

This is the first in a series of research articles that discuss the state of insurance for online marketplaces, to help you understand why insurance is challenging and what options are open to you.

You might also like...

Online marketplace design: the 5 principles of a great marketplace UX

Five key online marketplace design principles and tons of practical tips and examples. Courtesy of marketplace UX designer Fiona Burns.

Makerist founder Axel Heinz on how to validate a marketplace idea

Axel Heinz’s story proves that you can prevalidate your marketplace idea extremely affordably. And that you should.

Marketplace payments: The complete guide

Marketplace payments are very complex. This guide helps you list your feature requirements and compare and choose the best marketplace payment provider for you. (Yes, there's a comparison table!)

Start your 14-day free trial

Create a marketplace today!

- Launch quickly, without coding

- Extend infinitely

- Scale to any size

No credit card required