DAC7: What the new EU tax directive means for online marketplaces

The tax directive DAC7 extends EU tax transparency rules to online marketplaces and requires reporting seller data to tax authorities. In this article, we share what DAC7 is about and how it affects online marketplaces.

Published on

Last updated on

Marketplace platforms have become a staple of the internet age. They have considerable sway over the economy and affect both businesses and individuals. This means governments also seek to regulate them to guarantee transparency and fair taxation.

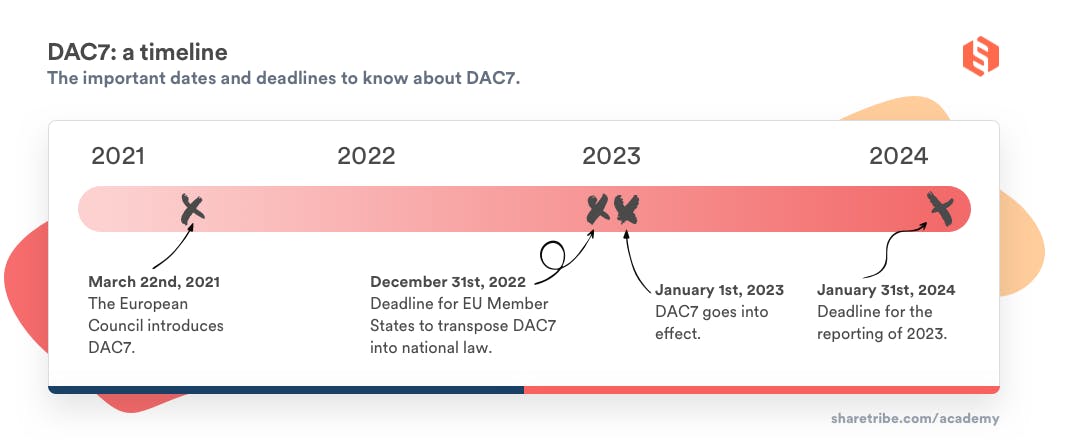

To this effect, the European Commission introduced a new tax directive, DAC7, which extends the EU's tax transparency rules to digital platforms. It requires yearly seller data reports from marketplaces and came into effect on January 1st, 2023.

In this article, we’ll discuss:

- What DAC7 is, exactly

- What you need to know about DAC7 as a marketplace operator

- Which data you need to collect, and from whom

- When to report the data.

DAC7 is an EU tax directive that requires digital platform operators in the EU to report revenue, personal, and business information about their providers to tax authorities once a year. It is the sixth amendment to the EU’s Directive on Administrative Cooperation in the field of taxation.

DAC7 defines a digital platform as any software (website or mobile application) that allows sellers to connect with other users to carry out a relevant commercial activity. This means online marketplaces, from peer-to-peer product, service, and accommodation platforms to ride-hailing, car-pooling, and food delivery apps, among others.

The directive came into effect on January 1st, 2023. The first reports were due on January 31st, 2024, on the calendar year 2023.

Now that DAC7 has come into effect, every marketplace founder should review how it affects their reporting responsibilities. Failure to report can lead to penalties for the marketplace. The directive excludes some platforms and sellers, which you will learn more about below.

The DAC7 directive affects marketplaces that operate in the EU. This includes both marketplaces that are based in the EU – in other words, are tax residents – and any marketplace that has sellers in the EU.

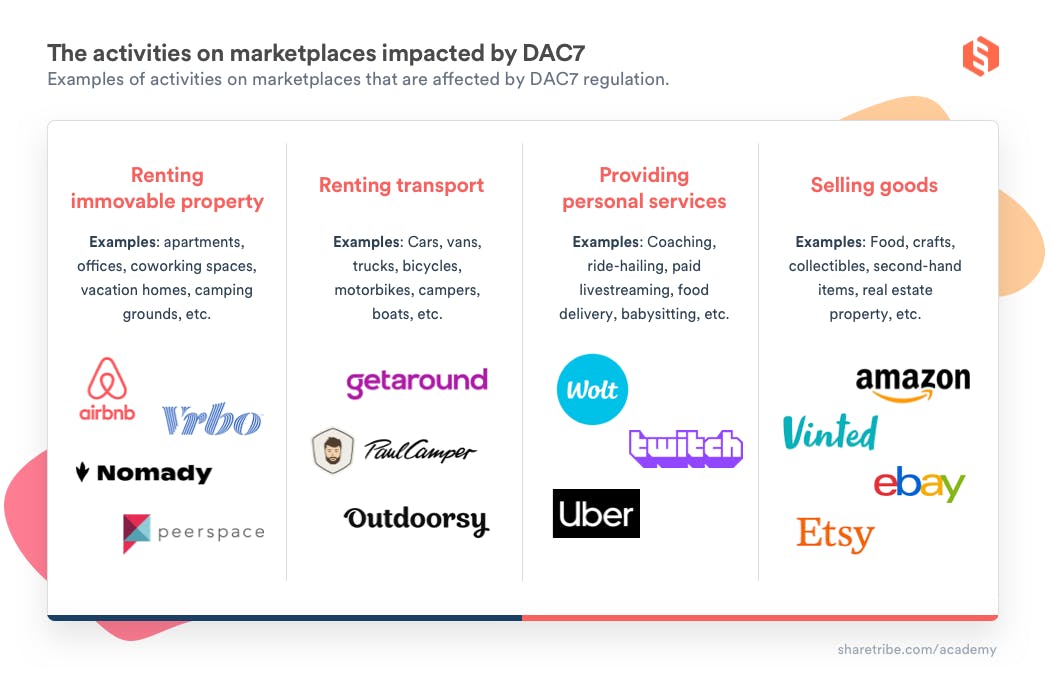

The directive impacts platforms with the following activities:

- Rental of immovable property, both residential and commercial

- Rental of any mode of transport

- Providing personal services

- Sale of goods

If your marketplace operates in any of these fields, you should pay careful attention to DAC7 and how it requires you to report on sellers and their revenue.

Marketplaces that deal with rentals of moveable assets (apart from transport) and peer-to-peer lending are excluded from the directive, at least for now. Examples of such marketplaces could be baby equipment and tool rental platforms.

However, these kinds of platforms will also need to provide some information to tax officials.

PWC writes that “even operators that are considered excluded from these obligations will need to annually file relevant documentation to prove their exemption.” So, marketplace owners still need to demonstrate to tax authorities that their platform does not involve the activities listed in the section above.

It is also possible that reporting on peer-to-peer lending and rentals of movable assets is mandated by your local tax law. Some countries may have additional (and stronger) regulations on top of DAC7. We recommend looking up your local tax regulation for digital platforms or getting in touch with a local tax representative if you have any questions.

There are certain services that DAC7 does not consider to be digital platforms. These are payment processors like Klarna or Stripe, messaging platforms like Whatsapp, platforms where users just list or advertise without payment – think classified ads – and directories that only link visitors to other sites. DAC7 does not impact these services.

Marketplace operators need to report the following information to tax authorities under DAC7:

- The seller’s identity information: full name, primary address, and date of birth.

- EU member state of residence.

- Financial account identifier: i.e. a bank account number or account identifier.

- Tax identification number.

- VAT or business registration numbers (if applicable: sellers who are private individuals will not have one).

- Consideration paid or credited per year. Consideration means the full amount of payments to a seller for the services or goods they’ve provided through the platform.

- Any fees, commissions, or taxes that the marketplace has withheld.

- The address of the immovable rental property (if applicable).

There are two types of providers that do not need to be reported on. These are:

- Casual sellers. A casual seller is someone who has, within a reportable period, fewer than 30 sales for which the total consideration does not exceed 2,000 euros. The reportable period means the 12 months of a reportable calendar year.

- Providers who are involved in high-frequency real estate renting, such as hotel chains or tour operators. This is to reduce unnecessary compliance costs for these businesses. For example, a hotel with multiple rooms and over 2,000 paid bookings through a marketplace in a year is not a reportable seller. But a single Airbnb apartment rented out by an individual is within DAC7’s impact.

However, local tax regulation applies here as well. It is possible your EU member state mandates reporting on these sellers, too, even though DAC7 does not require it.

Each marketplace operator is required to verify the information they collect from providers with consideration of GDPR, the EU’s data protection regulation.

You must inform your providers about the information you collect and why and treat the collected data as sensitive, private information. As a marketplace operator, you also need to store the data for 5 to 10 years, depending on country-specific regulations. It’s important to make sure your privacy policy takes DAC7 into account and is up to date. Our article on user data protection goes into more detail on privacy legislation and discusses how to collect and store your users' data in a way that complies with both reporting and data protection responsibilities.

The directive came into effect on January 1st, 2023. EU member states were obligated to transpose the directive into law by December 31st, 2022. The deadline for the first reports under DAC7 was January 31st, 2024, concerning data from 2023.

Each EU member state provides a method for reporting the information. All marketplaces affected need to report to one member state only. The states will share information with other countries in the EU when necessary.

Marketplace operators can be fined if the information DAC7 requires is not reported. You need to collect the required information from your providers and report it by the due date, January 31st, following the reportable year.

If your marketplace providers don’t provide you with the information on time, you are obligated to send them two reminders. If 60 days have passed and you still have not received the information, you need to close the provider’s account.

DAC7 has meant additional data collection and reporting for marketplace operators since 2023. The first time you need to report your sellers’ data and revenue information is January 31st, 2024, at the latest. Moving forward, DAC7 reporting is mandated yearly.

If your marketplace is affected, review the information you’re collecting from your sellers. It’s entirely possible that you or your marketplace payment provider are already collecting some or even all of the required information. If not, make changes to your data collection accordingly and request the data from providers when needed. Remember to take GDPR into account in your privacy policy and the way to manage and store the data.

You also need to have a way to export the information from your system. Sharetribe customers have a lot of built-in functionality to collect the necessary information under DAC7. Marketplace operators can choose which data they collect from users and modify the listing creation form. You can also easily export user, listing, and transaction data in CSV format.

If you’re using a third-party payment service provider, we recommend looking into what information is asked in their KYC process and finding out if that data is available for you for DAC7 reporting purposes.

For further information and answers to specific questions about the directive, you can always reach out to your local tax representatives. They can give you expert advice on both DAC7 and country-specific tax legislation.

Digital platforms are still relatively new forms of business, and legislation is catching up to protect fair taxation and transparency. These platforms already command large sections of markets like travel, transportation, and personal services.

In 2019, the EU started mandating Strong Customer Authentication (SCA) in online payments, which impacted marketplaces. Similarly, DAC7 extends tax reporting responsibilities to all marketplaces that have sellers in the EU. Marketplace operators need to report seller data to one EU member state.

DAC7 means some additional administrative work for most marketplace platforms each year. The regulation took effect on January 1st, 2023. If your marketplace is affected by it, remember to file a report under the directive every year on January 31st concerning the previous year. If you're building a new marketplace, it's good to make sure you have all the necessary info for DAC7 reports and the means to export it from the beginning.

It is still possible that countries have their own stricter tax legislation on top of DAC7, so getting in touch with local tax authorities to make sure you’re all set for reporting the required data is recommended.

Correction, 29 Sep 2022: Earlier, we defined excluded, casual sellers as sellers who have fewer than 30 sales within a quarter. This is incorrect. According to the directive (p. 48), sellers are excluded if they have fewer than 30 sales within a reportable period, i.e. the 12 months that correspond to a reportable calendar year. The total consideration for these sales cannot exceed 2,000 euros. Thank you kind folks at blocket.se for notifying us!

You might also like...

Marketplace financial crime – how to avoid the risks

Marketplaces can find themselves particularly at risk of financial crime. What specifically can happen on a marketplace – and how to avoid it?

Customer data protection: How online marketplaces can secure private customer information

To operate a marketplace, you need to collect and store a lot of personal information about your users. Learn how to keep it safe and secure.

How to build trust in your marketplace

Tactics to increase trust between your providers and customers – and to boost transactions.

How to build your marketplace supply

How to bring in the first, quality providers before your platform has any customers.

How to launch your marketplace

Strategies that bring demand to your freshly opened marketplace platform.

Start your 14-day free trial

Create a marketplace today!

- Launch quickly, without coding

- Extend infinitely

- Scale to any size

No credit card required