Marketplace payments: The complete guide

Marketplace payments are very complex. This guide helps you list your feature requirements and compare and choose the best marketplace payment provider for you. (Yes, there's a comparison table!)

Published on

Last updated on

Smooth and secure marketplace payments are a core value proposition for businesses like Airbnb, Etsy, and Upwork.

Processing payments is also critical to their business model. Most of today’s most successful marketplaces monetize through commissions. To do that, payments need to be processed on the platform.

This comprehensive guide helps you understand the marketplace payment flow, compare the more popular payment service providers, and choose the best payment provider for your business.

What's in this article:

- What is a marketplace: A marketplace facilitates payments between sellers and buyers. Payments are a strategically important feature for marketplaces.

- Why most marketplaces process payments: Payments are crucial for a marketplace’s revenue strategy, value proposition, and overall growth.

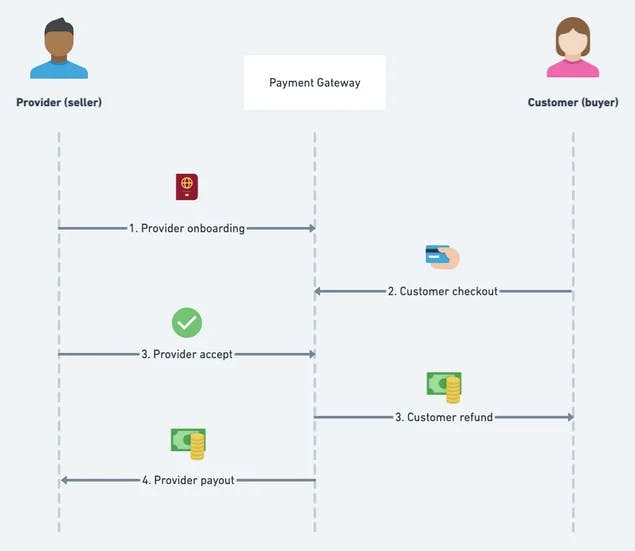

- How marketplace payments work: The standard payment flow involves seller onboarding, buyer checkout, and secure transaction handling. The most critical steps for marketplaces are delayed payouts and split payments.

- How to power payments on your marketplace: If you're building a marketplace with Sharetribe, online payments are included in your subscription. If you're building a marketplace from scratch (or with software that doesn't include online payments), you need to choose the right payment provider and build the integration yourself.

- What is a marketplace payment provider: A marketplace payment provider is a third-party service provider that specializes in facilitating payments on marketplaces and two-sided platforms.

- Why choosing the right payment partner is important: Your payment partners will impact your marketplace UX, your revenue strategy, cost structure, and scalability.

- 📌 Key marketplace payment feature requirements: List of the main things you should verify when you're choosing a payment partner.

- 📌 Compare the top 6 marketplace payment payment providers and their key features in a comparison table.

- 📌 Payment partner checklist: What to double-check before you start building an integration to a payment provider.

Once you've narrowed down your list of potential payment partners, check out our detailed overview articles that cover the essential features, pricing, integration, and more on the top payment providers: Stripe Connect, PayPal from Marketplaces, Mangopay, Adyen for Platforms, Ryft, Trustap, Fondy, and Mollie.

A marketplace is an online platform that connects sellers and buyers. Multiple sellers use the platform to list their products, rentals, or services, and customers use the marketplace to find what they’re looking for and make a purchase. Some famous examples of marketplace businesses are Airbnb, Amazon, and Uber.

The marketplace founder usually makes money from their platform by collecting commissions. For every payment made to a vendor on a marketplace, the platform collects a percentage of the total fee and sends the rest to the seller.

From a legal and technical point of view, the marketplace payment flow is very different from transactions that happen between a single vendor and a buyer.

A marketplace doesn't have to process payments. The platform could also help supply and demand find each other and communicate, but the payment happens off-platform. This is a typical model especially for classifieds sites like Craigslist. Their revenue model relies on charging a fee to post listings.

Most modern marketplaces, however, do process payments. Payments are a crucial component of most marketplace businesses because:

- Processing payments is essential for marketplace revenue.

- Payments provide value to buyers.

- Payments provide value to sellers.

- Smooth payments prevent platform leakage.

- Secure payments increase trust.

These are all critical components of the core value proposition of a marketplace. Let's look at each in a bit more detail.

Most marketplaces use commissions to make their platforms profitable. This percentage they charge is taken on every sale that happens on the platform.

If you’re not able to process payments (or if several users go around your payments system), you’re not able to benefit from arguably the most scalable marketplace business model.

A marketplace is valuable to customers if it can simplify finding and paying for what they need. Providing value to customers is a key aspect of your marketplace liquidity, which is ultimately the difference between whether you have a viable business or not.

Having a smooth payment feature for users is often a core component of a marketplace’s value proposition to customers.

Sellers are on your platform for one main reason – to make money.

Timely and reliable payouts to their accounts will keep them engaged and committed to your platform in the long run. When you control payment processing (rather than leaving it up to your buyers and sellers to deal with on their own), you can guarantee that your sellers get paid for the products or services they provide.

A smooth payment feature reduces the chance of marketplace users going around your platform.

Platform leakage can significantly reduce your commissions and, over time, reduce the number of buyers and sellers using your platform since they don’t need it to facilitate payments.

Online payments can be an easy target for different types of attacks. If you offer your users security and safety through your payment process, you can gain a competitive advantage and defensibility by building a high level of trust in your marketplace.

This is also the standard payment flow available out of the box with Sharetribe.

As you can see, the flow is very different from a standard eCommerce store. Such a store doesn't onboard or payout sellers and usually doesn't need a delayed payout. (We'll discuss all the essential features in a minute).

The needs for your payment flow will vary depending on your target audience and their requirements (which is why Sharetribe's transaction flow can be endlessly customized).

Let's look at each step in more detail so you can estimate if additional functionality is required at any of the steps.

In the first step, a seller will link their account with a payment provider or payment gateway.

Payment providers are third-party service providers that facilitate payments. After linking their account, sellers will provide information like the bank details where they want the payments from buyers transferred. Sellers will also submit any necessary documents for KYC requirements (Know Your Customer) and additional information to verify their identity.

After a buyer has selected a seller to buy or rent something from, they’ll be led to a checkout process to finalize the payment. At this point, they’ll initiate a transaction and provide payment details, e.g. credit or debit card number.

The payment gateway will then preauthorize the cash, which means they’ll reserve the money on the buyer’s card until the next step in the flow is completed.

Now that the buyer has checked out, the seller has two options: to either accept or reject the buyer’s request.

If accepted, the payment is captured and transferred to the payment gateway from the funds reserved earlier.

If the request isn’t accepted, the payment process ends here.

On some marketplaces, the payment can be captured right away without the seller accepting it separately. This can make for a smoother buyer experience, but the transaction in question needs to be a relatively straightforward purchase or booking.

Between the time that a buyer’s credit card is charged and when the seller receives the money in their bank account, the payment flow has a delayed period.

This period ensures payout is only released to the seller after they’ve provided the product or service the buyer pays for.

If the seller can’t deliver the order for one reason or another, the buyer's refund will be processed. The main advantage of the delayed payout is that a buyer can trust they'll get what they paid for or gets their money back.

Once the transaction is completed and the buyer receives what they paid for, the money held by the payment gateway is released to the seller.

You might wonder if it’s possible to simplify the five steps and not move money between all three parties. Why not accept the entire payment to your own bank account and handle refunds to customers and payouts to sellers manually?

However, this kind of workaround can lead to a myriad of issues in terms of regulation, accounting, and liability. If all the money goes to your account, it could be considered that you are holding money for third parties. This is a heavily regulated area, and in many countries, holding money without a license is a crime.

Handling all of the payouts to the sellers correctly can mean quite a lot of manual, error-prone labor, and it’s also not scalable in the long run.

Our strong recommendation to any marketplace founder is to integrate a payment provider that handles marketplace payments properly.

Most online businesses, including marketplaces, use a third-party payment provider to process payments. Payment providers specialize in payment infrastructure and are licensed to process payments.

If you're building your marketplace with Sharetribe, you have a pre-built integration with Stripe Connect, one of the leading payment providers. (You can also build a custom integration with any third-party payment provider you choose.) By creating an account with Stripe and connecting it with your marketplace, you can start processing payments with all the features listed above.

The task is a bit more complex if you're developing your marketplace from scratch (or using a software solution that doesn't include a payment integration). You'll need to build an integration between your marketplace and the payment service, and the complexity of this task depends a lot on your marketplace infrastructure and the API, documentation, and customer support offered by the payment service provider you choose.

So if you are in a situation where you need to build a custom integration to marketplace payment provider, where should you start?

The next part of this article helps you list your key marketplace payment feature requirements, and then use your requirements list to compare and choose the right payment provider for you.

Most online businesses, including marketplaces, use a third-party payment provider to process payments.

A payment service provider, or payment gateway, is a third-party service provider that facilitates monetary payments on your platform. In this article's lingo, a marketplace payment provider is a company that specializes in marketplaces and two-sided platforms or has a dedicated product for such businesses.

Examples of marketplace payment providers are Stripe's Connect (which comes pre-built with Sharetribe's marketplace builder), PayPal for Marketplaces, and MANGOPAY.

Providing online payments is a heavily regulated field where security and technical reliability are essential. Third-party providers take care of compliance and security for you.

Payment providers usually charge a fee per transaction and/or payout. Additional fees for payment methods or additional services, setup fees, and maintenance fees may also apply.

There are hundreds of payment providers out there. However, most of them don’t support critical marketplace features like split payments and delayed payouts.

For example, payment giants like Worldpay, Chase Paymentech, and Fiserv handle trillions of transactions annually. None of them supports all of the five steps in the standard marketplace transaction flow.

Even with this limitation, there are dozens of service providers you could choose. The rest of this guide helps you narrow your list of candidates, compare their key features, and make the best decision for you.

First, however, a quick word about what is at stake in this decision.

The payment provider you choose will impact key elements in your marketplace and business strategy. They will play a role in:

- your marketplace UX

- the speed and ease of building and maintaining your payments feature

- your revenue strategy

- scalability

- cost structure.

A few words on each point next.

When you make a payment online, many steps in the process are mandated by online payment regulation. However, there are differences between payment providers that have a big impact on your marketplace UX.

A key difference is whether the payment provider offers a white-label experience, a hosted experience, or a mix of both.

A white-label experience means that you build the payment flow inside your marketplace application. This way, you have control over the user-interface and branding.

Some payment providers offer a hosted experience, where the seller onboarding and customer payments happen by redirecting your user to the payment provider's website. With this model, you have limited control over the user-interface on the payment provider's website.

The most common solution combines hosted and white-label UX: Some stages of the payment flow use hosted pages, while others use white-label. This is usually a good compromise in terms of workload—more on that next.

Another component that depends on your payment provider is a multi-vendor shopping cart. Paying for multiple items from multiple different sellers with a single payment is a complicated feature that many payment providers don't support.

The choice between a white-label and hosted experience impacts the total cost of building and maintaining your payment integration.

Typically, a white-label experience requires much more work to build than a fully hosted payment experience. You may also need to do some work on PCI compliance.

A white-label experience also tends to require more maintenance: as payment regulations evolve, you're responsible for keeping your white-label payments compliant.

For example, on Sharetribe-powered marketplaces, some pages in the payment flow are white-label while the seller onboarding uses Stripe-hosted pages. This is because compliance with the Know Your Customer (KYC) guidelines is critical in this step, and the requirements differ between countries and regions and are subject to change as payment regulation evolves.

Mangopay and Adyen are other well-known payment companies that let you build a mix of white-label and hosted payment experience, whereas on payment providers like PayPal, the entire payment UX is hosted.

Most marketplaces monetize through commission: they take a percentage or a flat fee from every sale made on the platform. This requires a split payment functionality that's relatively complex to build, so most generic payment provider companies don't offer it.

Another relatively common revenue strategy is subscription payments: the marketplace charges a recurring fee from users to use the platform. Marketplaces may also use a combination of commission and subscription models. Some marketplace concepts may also require a functionality where the sellers on the marketplace charge a recurring subscription fee from their customers, and the marketplace charges its commission from those subscription fees.

Not all payment companies that offer split payments allow you to process subscriptions, for instance.

The countries, currencies, and payment methods your payment provider supports will set the constraint to where your platform can expand (with that particular payment provider, at least).

A payment service provider typically charges a fee on all transactions it powers. Some companies may have rather complicated additional fees based on additional services, payment methods, countries, accounts, or similar. Some may charge an initial setup fee, some may have a minimum monthly fee. Some payment providers may not even accept customers with low transaction volumes. Needless to say, this impacts the cost of running your marketplace and will probably need to be taken into account in your pricing strategy, for instance.

As we discussed earlier in this article, the typical marketplace payment flow is very different from the standard eCommerce payments.

This means that marketplaces need some key payment features that other eCommerce businesses don't.

In a nutshell, key marketplace requirements are:

- Support for your target market and payment methods

- Split payments

- Delayed payout and/or escrow

- Subscription payments

- Security and compliance

- Dispute handling and fraud prevention

- Tax reporting

- Reasonable payment provider service fees

- Easy integration

- High-quality customer support

A few words on each of these requirements next.

There are lots of differences in what countries, currencies, and payment methods payment providers support.

For marketplaces, this is further complicated by the fact that you need to be able to make payouts to your sellers. Payment providers may have a long general list of "countries supported", and a different, shorter list of countries where the bank accounts to which you make payouts can be located.

Furthermore, if you're considering a general payment provider that offers a distinct marketplace product (such as Stripe, Adyen, or PayPal), it's likely that the marketplace product is available in a different set of countries than the general payment product.

You also need to be able to handle payments and payouts in the local currencies of your markets. And finally, you want to make sure you support the the most popular payment methods in your target markets. For example, iDEAL is quite popular in The Netherlands, while in Mexico OXXO is a commonly used payment method.

If your marketplace business model is like Airbnb's, that means a payment by a customer is split into two parts: most of it goes to the provider, but you will charge your commission. (A small cut will also go to the payment service provider, but don't worry—for some reason, every payment provider has the required functionality in place to take its own cut!)

You might, however, be surprised to hear that many payment providers don't offer the ability to split a payment between multiple parties and send payouts to sellers. This is a key reason why we recommend marketplace founders only consider payment providers that explicitly mention they serve marketplaces and platforms.

You might be tempted to solve this problem by transferring all revenue to your own bank account and manually paying your providers every month. However, this approach not only doesn't scale well—it's often illegal. Holding money on behalf of sellers is heavily regulated in most jurisdictions.

Marketplaces like Airbnb don't immediately transfer the money paid by a customer to the host. Instead, they delay the payment until the guest has entered the accommodation successfully. This helps build trust in the marketplace and between sellers and buyers.

To delay the payout to the seller, a platform needs to be able to hold the money for a while after the customer has made the payment. This process is generally referred to as escrow: "a contractual arrangement in which a third party receives and disburses money or documents for the primary transacting parties".

As mentioned above, holding money on behalf of people is heavily regulated, and a license for offering escrow is required in most countries. This license can be quite hard to get. If a payment provider doesn't have an escrow license, they usually offer a featured called "delayed payouts" or similar. This allows you to delay the payout to your seller in a legally compliant way, but usually for a shorter period of time than a full-fledged escrow service.

Subscription payments (also called recurring payments) refer to situations where a marketplace stores customers’ credit card details to allow their sellers to bill their customers at regular intervals without requiring any action from the customer.

A few examples of marketplaces where subscription billing might be critical:

- A peer-to-peer storage platform, where the billing happens monthly until the customer removes their stuff from storage.

- A platform for booking home cleaning, where a customer can purchase a package of, for instance, two cleanings per month.

- An Airbnb-like platform for longer-term rentals, where the monthly rent is paid automatically through the platform.

Enabling subscription billing can be pretty complicated. You need to figure out what happens when a recurring payment fails due to an expired credit card, how to deal with disputes, how a subscription is canceled, how refunds are dealt with, and so on.

There are few payment providers that we know of that offer subscription features that work seamlessly with the other payment features marketplaces need, like split payments. Stripe Connect and Mangopay are two of them. Some payment providers (like Adyen) offer subscription features with their general product but don't offer documentation about its compatibility with the marketplace product.

If this is a core feature requirement, it's good to double-check its availability with the payment provider you're considering. This feature may turn out to be decisive for your choice of payment provider.

The security of your online payments forms a key part of your overall marketplace security. Online payments are subject to multiple legal and regulatory requirements to secure payments. Some examples of regulatory requirements include the KYC process, PCI DSS, PSD2 & SCA, GDPR, and any local requirements specific to your local regulators.

Know Your Customer (KYC) refers to laws related to paying out funds to individuals and companies. Every country has its own regulations, but the process usually entails collecting and verifying specific information about each individual or company receiving funds. The collected information typically includes at least a legal name, birth date, and address, but it can also include things like ID verification and submitting other legal documents.

From the point of view of user experience, this presents a challenge for marketplaces that have a large number of sellers to which they need to move money. Many of these people are individuals who might only be making a few hundred dollars per year. A marketplace can't afford to handle the KYC process for every such individual manually. At the same time, these individuals will likely have little patience with the process: if it's too difficult or time-consuming, they will give up.

In other words, it's crucial that your payment service provider offers tools that automate the KYC process and make it as easy as possible for individuals.

PSD2 is an example of EU payment regulation that brought along a big change to online payments when it came into effect in 2019. In short, the regulation introduced the requirement for Strong Customer Authentication (SCA) in online payments. Usually, payment providers achieve this by using the 3D Secure 2 protocol. Another example of EU regulation that affects online payments is the GDPR.

PCI DSS is an information security standard that is designed to eliminate credit card fraud. It's not a legal requirement in most jurisdictions, but its use is required by the major credit card brands.

Choosing a payment provider that keeps your marketplace compliant is an absolute necessity and a legal requirement for handling any form of payment on your platform.

In addition, many payment providers offer their own additional security features, such as fraud detection and management tools.

Marketplaces can be vulnerable to fraud and financial crime. If your marketplace has delayed payouts, there's an important additional factor you should consider: delayed payouts make you liable for credit card disputes, also called chargebacks.

In credit card disputes, the owner of the credit card files a complaint to the credit card company after they've bought a product or a service. Especially in the United States, credit card companies usually take the side of the customer, return the money, and charge it from the provider. This has resulted in a problem that plagues many online marketplaces: dishonest customers file disputes even though they have received the product or service they purchased.

If you don't delay payouts, the seller is typically responsible for the costs associated with a chargeback. If you delay payouts, you might be liable for the chargeback, which can mean significant costs for you. You can, of course, dictate in your terms of use that the sellers are responsible for chargebacks, but you will then need to handle money collection from them, and if they refuse to pay, the ultimate legal responsibility lies with you.

The 2019 change in European payment regulation introduced a considerable improvement to chargebacks. If your payment service provider uses the 3D Secure 2 protocol to verify payments, liability for disputes is shifted to the credit card issuer. Card issuers are responsible for covering any payment verified through the 3DS 2 protocol and disputed as fraudulent. Most payment providers offer 3D Secure 2 verification.

If your individual sellers' monthly volume is high enough, they typically need to report their income to tax officials. If the income consists of a large number of small transactions, this can be a complicated process.

Naturally, variations exist in local legislation. For example, the EU's DAC7 regulation came into effect in 2023 and extends tax transparency rules to online marketplaces. In the US, marketplace facilitator laws vary by state.

This is a complex area to handle well, and no payment provider offers comprehensive tools for all countries. However, while such tools can be helpful, they're generally not the first priority since they only start to offer value when the volumes of individual providers become substantial.

Costs are naturally an important factor to consider when choosing a payment service provider.

Most payment providers set their fees based on transaction volume. The cost typically involves a small fixed fee per transaction and a percentage of the total amount paid.

However, there are lots of variations. Many payment providers, like Stripe, PayPal, and Mangopay have additional fees for specific services. Adyen, for example, bases its charges on the payment method used. PayPal's pricing is determined by location and transaction volume. Some, like Mangopay, have an additional integration fee. Adyen for Platforms, on the other hand, has a minimum monthly invoice.

This makes pricing comparisons extremely difficult. This table we compiled lists the pricing information of the major marketplace payment providers.

Building a payment system for an online marketplace can be a complicated task. Especially if you're a small company, the speed of integration could be even more important in a payment provider than its exact feature set.

Some services are easier to integrate than others. The first place to gauge this is the payment provider's developer documentation. If you’re hiring developers, consult them and ask for an estimate for building the integration for each payment provider separately.

If you're using a marketplace builder, you may get a pre-built payment integration. Sharetribe, for example, offers a Stripe Connect integration out of the box (and you can build a custom integration to any other provider you choose.)

Your payment service provider is an important business partner, and you should expect to talk to them often. This communication must flow well.

In general, this is an area where smaller payment providers excel. In the realm of marketplaces, there are several small and mid-sized companies that focus exclusively on marketplaces.

A small company won’t be able to compete against larger players in terms of feature set. They need to make up for this by focusing on a narrow enough segment and offering dedicated support. In addition, providing high-quality support is a lot easier for a small company with a relatively modest feature set, since everyone in the support team will know everything about the product.

Once you've found a couple of providers you're seriously considering, it can be a good idea to send each of them a bunch of questions and note how happy you are with the communication.

In our conversations with marketplace founders, we’ve learned that some payment providers only accept marketplace customers once they meet certain volume or minimum-billing criteria. These thresholds are seldom published, which might mean acceptance depends on multiple factors like your marketplace’s transaction volume, growth estimates, payout frequency, business model, and region.

A good first indication of such limitations is the payment provider's cost structure (which you can compare in the table below), and particularly if they have minimum monthly fees or other billing structures that aren't feasible for lower volumes. If you’re in early or low-volume stages, it’s worth contacting the provider to confirm whether they support smaller marketplaces or would consider a custom fee or onboarding plan.

Marketplace entrepreneurs are usually best off with a payment provider that specializes in marketplaces.

Sharetribe-powered marketplaces come with Stripe Connect already integrated, but it’s possible to integrate your marketplace with any other 3rd party payment gateway. While most of our customers are using Stripe, some have built integrations to services like Paypal, Mangopay, Trusapp, Two, Razorpay, and Tipalti.

Below, you'll find more details on seven marketplace payment providers: Stripe Connect, PayPal for Marketplaces, Adyen for Platforms, Mangopay, Trustap, Ryft, and Fondy.

Stripe is one of the best-known payment service providers in the world. Stripe Connect is built specifically to cater to online marketplace needs. Some famous marketplace unicorns like Lyft, Instacart, Postmates, and Thumbtack trust Stripe Connect as their payment provider, as do hundreds of Sharetribe-powered marketplaces.

Paypal is another global payment provider that online marketplaces have used for years. Paypal is also the largest company in our comparison, with a market capitalization of over $60 billion. Like Stripe, Paypal built a product dedicated to online marketplaces, Paypal for Marketplaces. It lists eBay, Poshmark, and StockX as customers.

In 2015, Adyen launched Adyen for Platforms (formerly MarketPay) specifically for marketplaces. The company lists eBay and Vinted as its marketplace customers. The company has focused on winning market share by offering lower fees than its competitors. At the time of writing, Adyen has a market capitalization of over $45 billion.

Mangopay caters purely to marketplace businesses and crowdfunding platforms. It’s a relatively well-known alternative to the giants, especially in Europe. Mangopay was acquired by French bank Crédit Mutuel Arkéa in 2015 and then acquired again in 2023 by AdventPay, while Crédit Mutuel remained a minority shareholder. Marketplaces on MangoPay include Vinted, Rakuten, and Wallapop.

Trustap is an end-to-end transaction management platform specifically designed for online marketplaces. In addition to escrow-style payments, the service includes integrated shipping and logistics as well as customer support and dispute resolution.

Ryft also focuses solely on marketplaces and platforms. The company was founded in 2019 by Sadra Hosseini and Alex Mackenzie, entrepreneurs who previously built their own online marketplace business and wanted to create a payment solution to address the pain points they discovered. Ryft powers over 100 marketplaces in Europe and the UK and is currently pursuing a Series A round with a valuation of £30 million.

Fondy was founded in 2019 by Valeria Vahorovska and is headquartered in London, United Kingdom. It's main product, Fondy Flow, is a payment solution designed specifically for platforms and marketplaces.

Mollie was founded in 2004 by Adriaan Mol, who bootstrapped the company with a vision to challenge legacy technology providers and make payments simple and accessible. Its marketplace payments offering is available in the EEA, Switzerland, and the UK.

Compare the availability, pricing, and key features of top payment providers for marketplaces below.

| Payment Provider | Countries where available | Payout countries | Currencies | Payment methods | Split payments | Subscription payments | Escrow/delayed payouts | Costs | Noteworthy |

|---|---|---|---|---|---|---|---|---|---|

| Stripe Connect | 46 countries including: United States, Canada, Brazil, United Kingdom, France, Germany, India, Japan, Australia | Limitations depending on account type. Fully supported countries include: United States, Canada, Brazil, United Kingdom, France, Germany, India, Australia | 135+ currencies including: USD, CAD, BRL, AUD, GBP, EUR, INR | Credit and debit cards, ACH, Link, Alipay, Apple Pay, Klarna, WeChat Pay, PayPal (upon request), and more | Yes | Yes | Up to 90 days with manual payouts | In the US: 2.9% + 30¢, In the EEA: 1.5% + €0.25, 2.5% + €0.25 for UK cards. Active account fee and payout fee for Express and Custom accounts. Additional Stripe fees apply. | The only payment provider that comes pre-built in Sharetribe. (You can build your own integration to any service provider.) |

| PayPal for Marketplaces | 200 countries including: United States, Canada, Brazil, South Africa, United Kingdom, France, Germany, India, China, Japan, Australia | More restricted; including: United States, Canada, Brazil, United Kingdom, France, Germany, China, Japan, Australia (Select your country on this list and check availability) | 24 currencies including: USD, CAD, BRL, AUD, GBP, EUR, JPY, CNY | Credit and debit card, PayPal, Venmo, Sofort, iDEAL, and more | Yes | Yes | Up to 28 days with delayed disbursement | Transaction fee between 2%–5% + payout fee. Fees are based on location and transaction volume + additional fees. Most country-specific information isn't publicly available. Examples: US fees, UK fees, France fees | |

| Adyen for Platforms | 30+ countries including: United States, Canada, United Kingdom, France, Germany, Singapore, Australia | 30+ payout countries including: United States, Canada, United Kingdom, France, Germany, Singapore, Australia | Local currencies of the supported countries. Payouts allowed only in the local currency. | Credit and debit cards, PayPal, Alipay, Apple Pay, Google Pay, Klarna, iDEAL, and more | Yes | Possibly | Information not available | Fee determined by the payment method | |

| MangoPay | 170+ countries including: United States, Canada, Brazil, South Africa, United Kingdom, France, Germany, India, China, Japan, Australia | 170 countries including: United States, Canada, Brazil, South Africa, United Kingdom, France, Germany, India, China, Japan, Australia | 15 currencies including: USD, CAD, ZAR, GBP, EUR, JPY | Credit and debit card, Apple Pay, Google Pay, iDEAL, PayPal, Klarna, and more | Yes | Yes | Unlimited escrow in Mangopay's e-wallet. | Card pay-in 1.4% + €0.25, Platform fee €249 per month, Payout €0.20, Additional fees apply.* | Built for marketplaces and platforms. |

| Trustap | 100+ countries including: USA, Canada, UK, Ireland, France, Germany, Italy, Spain, Australia, UAE | 100+ countries including: USA, Canada, UK, Ireland, France, Germany, Italy, Spain, Australia, UAE | 100+ currencies including: USD, EUR, GBP, CAD, AUD | Credit and debit card, Apple Pay, Google Pay, iDEAL, Klarna, ACH, BACS, Bank Transfers, Open Banking | Yes (public documentation not available) | Yes (public documentation not available) | Yes. Fully customisable automated payouts triggered by milestones. | Card from 1.8% + €0.30 (volume-based discounts available). Bank Transfer: 0.25%—1.5% depending on value. | Built for marketplaces and platforms. Offers an optional Merchant of Record service, moving the liability, cost and other downsides of transactions away from the marketplace. |

| Ryft | UK, Europe | UK, Europe, US | 15 currencies including: USD, CAD, ZAR, GBP, EUR, JPY | Credit and debit card, Apple Pay, Google Pay, Amex | Yes | Yes | Unlimited escrow | <1% + £0.10 (volume based. Minimum billing: £1k monthly, no payout or account fees. | Built for marketplaces and platforms. |

| Fondy | 200+ countries including: US, Canada, United Kingdom, Australia, New Zeland, France, Germany, Ireland, Poland. | 30+ countries including: United Kingdom, European Union. | 150 currencies including: GBP, EUR, USD, PLN, HUF, CZK, RON, BGN, HRK. | Credit and debit cards, Apple Pay, Google Pay, PayPal, BNPL options, Local payment methods (e.g., iDEAL, Sofort), and more | Yes | Yes | Yes, with flexible settings in Fondy Wallets | .Transaction fees start from 0,7% + £0.20 per transaction (may vary based on country and method). No monthly fees (besides Virtual IBANs - from £10 monthly. Payout fees £0.20. No hidden fees. | Built for marketplaces and platforms. |

| Mollie | European Economic Area (EEA), Switzerland, UK | European Economic Area (EEA), Switzerland, UK | EUR, GBP, AUD, CAD, CZK, DKK, HUF, NOK, PLN, SEK, CHF, USD | Credit and debit cards, Apple Pay, Google Pay, iDEAL, Giftcards, PayPal, Klarna, and more | Yes | Not yet | Yes, max. 90 days | One-off onboarding fee €5/new sub-merchant. Monthly usage fee €1.75/each active sub-merchant. Variable routing fee 0.2% on processed payments. Transaction fees vary by payment method. | Broad range of local payment options in Europe. |