Guide to marketplace payments

Understand how marketplace payments work and choose the best payment provider for you.

Published on

Last updated on

Smooth and secure marketplace payments are a core value proposition for businesses like Airbnb, Etsy, and Upwork.

Processing payments is also critical to their business model. Most of today’s most successful marketplaces monetize through commissions. To do that, payments need to be processed on the platform.

This comprehensive guide helps you understand the marketplace payment flow, compare the more popular payment service providers, and choose the best payment provider for their business.

What's in this article:

- What is a marketplace: A marketplace facilitates payments between sellers and buyers. Payments are a strategically important feature for marketplaces.

- Why marketplace payments are important: Payments are crucial for a marketplace’s revenue strategy, value proposition, and overall growth.

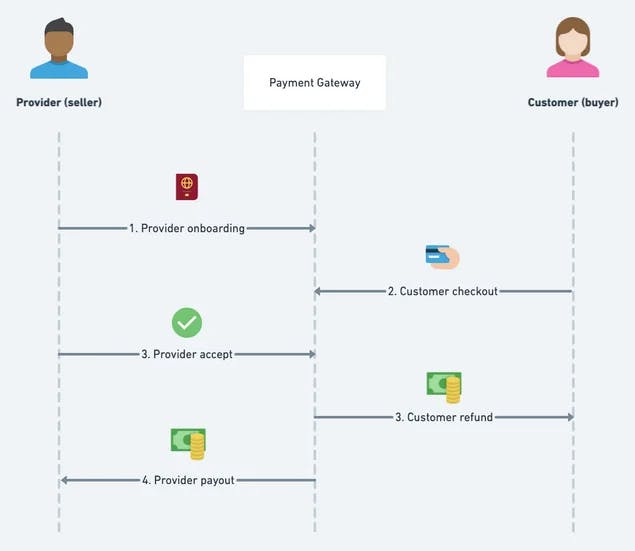

- How marketplace payments work: The standard payment flow involves seller onboarding, buyer checkout, and secure transaction handling. The most critical steps for marketplaces are delayed payouts and split payments.

- How to power payments on your marketplace: If you're building a marketplace with Sharetribe, online payments are included in your subscription. If you're building a marketplace from scratch (or with software that doesn't include online payments), you need to choose the right payment provider and build the integration yourself.

- Key payment requirements for marketplaces: In addition to split payments and delayed payouts, you need support for your location, currency, and payment methods, security and legal compliance, easy integration, and reasonable service costs.

In the follow-up articles of the series, we'll help you to:

- Compare marketplace payment providers. This article lists the most important payment providers that have a dedicated marketplace offering and compares their key features.

- Read about specific payment providers. Our detailed articles cover the essential features, pricing, integration, and more on the top payment providers: Stripe Connect, PayPal from Marketplaces, Mangopay, Adyen for Platforms, and Ryft.

A marketplace is an online platform that connects sellers and buyers. Multiple sellers use the platform to list their products, rentals, or services, and customers use the marketplace to find what they’re looking for and make a purchase. Some famous examples of marketplace businesses are Airbnb, Amazon, and Uber.

The marketplace founder usually makes money from their platform by collecting commissions. For every payment made to a vendor on a marketplace, the platform collects a percentage of the total fee and sends the rest to the seller.

From a legal and technical point of view, the marketplace payment flow is very different from transactions that happen between a single vendor and a buyer.

Payments are a crucial component of a marketplace business because:

- Processing payments is essential for marketplace revenue.

- Payments provide value to buyers.

- Payments provide value to sellers.

- Smooth payments prevent platform leakage.

- Secure payments increase trust.

These are all critical components of the core value proposition of a marketplace. Let's look at each in a bit more detail.

Most marketplaces use commissions to make their platforms profitable. This percentage they charge is taken on every sale that happens on the platform.

If you’re not able to process payments (or if several users go around your payments system), you’re not able to benefit from arguably the most scalable marketplace business model.

A marketplace is valuable to customers if it can simplify finding and paying for what they need. Providing value to customers is a key aspect of your marketplace liquidity, which is ultimately the difference between whether you have a viable business or not.

Having a smooth payment feature for users is often a core component of a marketplace’s value proposition to customers.

Sellers are on your platform for one main reason – to make money.

Timely and reliable payouts to their accounts will keep them engaged and committed to your platform in the long run. When you control payment processing (rather than leaving it up to your buyers and sellers to deal with on their own), you can guarantee that your sellers get paid for the products or services they provide.

A smooth payment feature reduces the chance of marketplace users going around your platform.

Platform leakage can significantly reduce your commissions and, over time, reduce the number of buyers and sellers using your platform since they don’t need it to facilitate payment.

Online payments can be an easy target for fraud. If you offer your users security and safety through your payment process, you can gain a competitive advantage and defensibility by building a high level of trust in your marketplace.

This is also the standard payment flow available out of the box with Sharetribe.

As you can see, the flow is very different from a standard eCommerce store. Such a store doesn't onboard or payout sellers and usually doesn't need a delayed payout. (We'll discuss all the essential features in a minute).

The needs for your payment flow will vary depending on your target audience and their requirements (which is why Sharetribe's transaction flow can be endlessly customized).

Let's look at each step in more detail so you can estimate if additional functionality is required at any of the steps.

In the first step, a seller will link their account on your marketplace with a payment provider or payment gateway.

Payment providers are third-party service providers that facilitate payments. After linking their account, sellers will provide information like the bank details where they want the payments from buyers transferred. Sellers will also submit any necessary documents for KYC requirements (Know Your Customer) and additional information to verify their identity.

After a buyer has selected a seller to buy a service or item from, they’ll be led to a checkout process to finalize the payment. At this point, they’ll initiate a transaction and provide payment details, e.g. credit or debit card number.

The payment gateway will then preauthorize the cash, which means they’ll reserve the money on the buyer’s card until the next step in the flow is completed.

Now that the buyer has checked out, the seller has two options: to either accept or reject the buyer’s request.

If accepted, the payment is captured and transferred to the payment gateway from the funds reserved earlier.

If the request isn’t accepted, the payment process ends here.

Between the time that a buyer’s credit card is charged and when the seller receives the money in their bank account, the payment flow has a delayed period.

This period ensures payout is only released to the seller after they’ve provided the service the buyer pays for.

If the seller can’t deliver the service for one reason or another, the buyer's refund will be processed. The main advantage of the delayed payout is that a buyer can trust that your platform delivers the service they paid for or gets their money back.

Once the transaction is completed and the buyer receives what they paid for, the money held by the payment gateway is released to the seller.

You might wonder if it’s possible to simplify the five steps and not move money between all three parties. Why not accept the entire payment to your own bank account and handle refunds to customers and payouts to sellers manually?

However, this kind of workaround can lead to a myriad of issues in terms of regulation, accounting, and liability. If all the money goes to your account, it could be considered that you are holding money for third parties. This is a heavily regulated area, and in many countries, holding money without a license is a crime.

Handling all of the payouts to the sellers correctly can mean quite a lot of manual, error-prone labor, and it’s also not scalable in the long run.

Our strong recommendation to any marketplace founder is to integrate a payment provider that handles marketplace payments properly.

Most online businesses, including marketplaces, use a third-party payment provider to process payments. Payment providers specialize in payment infrastructure and are licensed to process payments.

If you're building your marketplace with Sharetribe, you have a pre-built integration with Stripe Connect, one of the leading marketplace payment providers. (You can also build a custom integration with any third-party payment provider you choose.) By creating an account with Stripe and connecting it with your marketplace, you can start processing payments with all the features listed above.

The task is a bit more complex if you're developing your marketplace from scratch (or using a software solution that doesn't include a payment integration). You'll need to build an integration between your marketplace and the payment service, and the complexity of this task depends a lot on your marketplace infrastructure and the API, documentation, and customer support offered by the payment service provider you choose.

Next, let's look at what the key features are that you should look for in a payment provider. (The next article of this guide helps you compare payment providers based on these key features.)

To support the payment flow we just went through, marketplaces need some key payment features that other eCommerce businesses don't.

In a nutshell, key marketplace requirements are:

- Support for your target market and payment methods

- Spilt payments

- Delayed payout and/or escrow

- Subscription payments

- Security and compliance

- Dispute handling and fraud prevention

- Tax reporting

- Reasonable payment provider service fees

- Easy integration

- High-quality customer support

A few words on each of these requirements next.

There are lots of differences in what countries, currencies, and payment methods payment providers support.

For marketplaces, this is further complicated by the fact that you need to be able to make payouts to your sellers. Payment providers may have a long general list of "countries supported", and a different, shorter list of countries where the bank accounts to which you make payouts can be located.

Furthermore, if you're considering a general payment provider that offers a distinct marketplace product (such as Stripe, Adyen, or PayPal), it's likely that the marketplace product is available in a different set of countries than the general payment product.

You also need to be able to handle payments and payouts in the local currencies of your markets. And finally, you want to make sure you support the the most popular payment methods in your target markets. For example, iDEAL is quite popular in The Netherlands, while in Mexico OXXO is a commonly used payment method.

If your marketplace business model is like Airbnb's, that means a payment by a customer is split into two parts: most of it goes to the provider, but you will charge your commission. (A small cut will also go to the payment service provider, but don't worry—for some reason, every payment provider has the required functionality in place to take its own cut!)

You might, however, be surprised to hear that many payment providers don't offer the ability to split a payment between multiple parties and send payouts to sellers. This is a key reason why we recommend marketplace founders only consider payment providers that explicitly mention they serve marketplaces and platforms.

You might be tempted to solve this problem by transferring all revenue to your own bank account and manually paying your providers every month. However, this approach not only doesn't scale well—it's often illegal. Holding money on behalf of sellers is heavily regulated in most jurisdictions.

Marketplaces like Airbnb don't immediately transfer the money paid by a customer to the host. Instead, they delay the payment until the guest has entered the accommodation successfully. This helps build trust in the marketplace and between sellers and buyers.

To delay the payout to the seller, a platform needs to be able to hold the money for a while after the customer has made the payment. This process is generally referred to as escrow: "a contractual arrangement in which a third party receives and disburses money or documents for the primary transacting parties".

As mentioned above, holding money on behalf of people is heavily regulated, and a license for offering escrow is required in most countries. This license can be quite hard to get. If a payment provider doesn't have an escrow license, they usually offer a featured called "delayed payouts" or similar. This allows you to delay the payout to your seller in a legally compliant way, but usually for a shorter period of time than a full-fledged escrow service.

Subscription payments (also called recurring payments) refer to situations where a marketplace stores customers’ credit card details to allow their sellers to bill their customers at regular intervals without requiring any action from the customer.

A few examples of marketplaces where subscription billing might be critical:

- A peer-to-peer storage platform, where the billing happens monthly until the customer removes their stuff from storage.

- A platform for booking home cleaning, where a customer can purchase a package of, for instance, two cleanings per month.

- An Airbnb-like platform for longer-term rentals, where the monthly rent is paid automatically through the platform.

Enabling subscription billing can be pretty complicated. You need to figure out what happens when a recurring payment fails due to an expired credit card, how to deal with disputes, how a subscription is canceled, how refunds are dealt with, and so on.

There are few payment providers that we know of that offer subscription features that work seamlessly with the other payment features marketplaces need, like split payments. Stripe Connect and Mangopay are two of them. Some payment providers (like Adyen) offer subscription features with their general product but don't offer documentation about its compatibility with the marketplace product.

If this is a core feature requirement, it's good to double-check its availability with the payment provider you're considering. This feature may turn out to be decisive for your choice of payment provider.

Online payments are subject to multiple legal and regulatory requirements to secure payments. Some examples of regulatory requirements include the KYC process, PCI DSS, PSD2 & SCA, GDPR, and any local requirements specific to your local regulators.

Know Your Customer (KYC) refers to laws related to paying out funds to individuals and companies. Every country has its own regulations, but the process usually entails collecting and verifying specific information about each individual or company receiving funds. The collected information typically includes at least a legal name, birth date, and address, but it can also include things like ID verification and submitting other legal documents.

From the point of view of user experience, this presents a challenge for marketplaces that have a large number of sellers to which they need to move money. Many of these people are individuals who might only be making a few hundred dollars per year. A marketplace can't afford to handle the KYC process for every such individual manually. At the same time, these individuals will likely have little patience with the process: if it's too difficult or time-consuming, they will give up.

In other words, it's crucial that your payment service provider offers tools that automate the KYC process and make it as easy as possible for individuals.

PSD2 is an example of EU payment regulation that brought along a big change to online payments when it came into effect in 2019. In short, the regulation introduced the requirement for Strong Customer Authentication (SCA) in online payments. Usually, payment providers achieve this by using the 3D Secure 2 protocol. Another example of EU regulation that affects online payments is the GDPR.

PCI DSS is an information security standard that is designed to eliminate credit card fraud. It's not a legal requirement in most jurisdictions, but its use is required by the major credit card brands.

Choosing a payment provider that keeps your marketplace compliant is an absolute necessity and a legal requirement for handling any form of payment on your platform.

In addition, many payment providers offer their own additional security features, such as fraud detection and management tools.

Marketplaces can be vulnerable to fraud and financial crime. If your marketplace has delayed payouts, there's an important additional factor you should consider: delayed payouts make you liable for credit card disputes, also called chargebacks.

In credit card disputes, the owner of the credit card files a complaint to the credit card company after they've bought a product or a service. Especially in the United States, credit card companies usually take the side of the customer, return the money, and charge it from the provider. This has resulted in a problem that plagues many online marketplaces: dishonest customers file disputes even though they have received the product or service they purchased.

If you don't delay payouts, the seller is typically responsible for the costs associated with a chargeback. If you delay payouts, you might be liable for the chargeback, which can mean significant costs for you. You can, of course, dictate in your terms of use that the sellers are responsible for chargebacks, but you will then need to handle money collection from them, and if they refuse to pay, the ultimate legal responsibility lies with you.

The 2019 change in European payment regulation introduced a considerable improvement to chargebacks. If your payment service provider uses the 3D Secure 2 protocol to verify payments, liability for disputes is shifted to the credit card issuer. Card issuers are responsible for covering any payment verified through the 3DS 2 protocol and disputed as fraudulent. Most payment providers offer 3D Secure 2 verification.

If your individual sellers' monthly volume is high enough, they typically need to report their income to tax officials. If the income consists of a large number of small transactions, this can be a complicated process.

Naturally, variations exist in local legislation. For example, the EU's DAC7 regulation came into effect in 2023 and extends tax transparency rules to online marketplaces.

This is a complex area to handle well, and no payment provider offers comprehensive tools for all countries. However, while such tools can be helpful, they're generally not the first priority since they only start to offer value when the volumes of individual providers become substantial.

Costs are naturally an important factor to consider when choosing a payment service provider.

Most marketplace payment providers set their fees based on transaction volume. The cost typically involves a small fixed fee per transaction and a percentage of the total amount paid.

However, there are lots of variations. Many payment providers, like Stripe, PayPal, and Mangopay have additional fees for specific services. Adyen, for example, bases its charges on the payment method used. PayPal's pricing is determined by location and transaction volume. Some, like Mangopay, have an additional integration fee. Adyen for Platforms, on the other hand, has a minimum monthly invoice.

This makes pricing comparisons extremely difficult. This table we compiled lists the pricing information of the major marketplace payment providers.

Building a payment system for an online marketplace can be a complicated task. Especially if you're a small company, the speed of integration could be even more important in a payment provider than its exact feature set.

Some services are easier to integrate than others. The first place to gauge this is the payment provider's developer documentation. If you’re hiring developers, consult them and ask for an estimate for building the integration for each payment provider separately.

If you're using a marketplace builder, you may get a pre-built payment integration. Sharetribe, for example, offers a Stripe Connect integration out of the box (and you can build a custom integration to any other provider you choose.)

Your payment service provider is an important business partner, and you should expect to talk to them often. This communication must flow well.

In general, this is an area where smaller payment providers excel. In the realm of marketplaces, there are several small and mid-sized companies that focus exclusively on marketplaces.

A small company won’t be able to compete against larger players in terms of feature set. They need to make up for this by focusing on a narrow enough segment and offering dedicated support. In addition, providing high-quality support is a lot easier for a small company with a relatively modest feature set, since everyone in the support team will know everything about the product.

Once you've found a couple of providers you're seriously considering, it can be a good idea to send each of them a bunch of questions and note how happy you are with the communication.

Marketplace payments are complicated.

A typical payment flow contains five steps: seller onboarding, buyer checkout, delayed payout (and buyer refund), and seller payout. Any payment provider that caters to marketplaces must handle at least these steps.

Smooth and secure payments are crucial for a marketplace's revenue strategy, value proposition, and overall growth. Most of today’s most successful marketplaces monetize through commissions, which requires payment processing within the marketplace platform.

This is why Sharetribe’s no-code builder gives you a Stripe integration out of the box and also allows you to integrate any other payment provider through coding with the Integration API.

Most online businesses support online payment with the help of a third-party payment provider. For marketplaces, it's generally a good idea to choose a payment provider that specializes in marketplaces to ensure the key functionality is there. The core features for marketplaces include support for your target location, split payments, delayed payouts, and Know Your Customer process. In addition, things like costs, ease of integration, and quality of customer support play a role.

In the next articles of this series, we'll give you plenty of information for the first step: choosing the best payment partner for you. This article compares marketplace payment providers in terms of their key features and pricing. Once you've narrowed down your list of candidates, you can read more about the top companies in our thorough overview articles on Stripe Connect, PayPal from Marketplaces, Mangopay, Adyen for Platforms, and Ryft.

More articles for you

Stripe marketplace payments – overview of Stripe Connect key features

Stripe Connect key features, fees, security compliance, integration and more.

Mangopay marketplace payments – overview of key features

Are you considering Mangopay to power your marketplace payments? Here's a detailed overview of Mangopay’s marketplace payment features.

How to hire a software developer to build your marketplace

Find out if it's time for your to find a marketplace developer and, if yes, how to find the right one.

Start your 14-day free trial

Create a marketplace today!

- Launch quickly, without coding

- Extend infinitely

- Scale to any size

No credit card required