Last updated

Enable PaymentIntents

Overview of how Stripe PaymentIntents work in FTW, and how you can change older FTW version to support for Strong Customer Authentication (SCA).

Table of Contents

- 1. Process change

- 2. Add new thunk calls to stripe.duck.js

- 3. CheckoutPage: add new API calls and call them in sequence

- Step 1. onInitiateOrder

- Step 2. onConfirmCardPayment

- Step 3. onConfirmPayment

- Step 4. onSendMessage

- 4. CheckoutPage: save updated transaction

- 5. StripePaymentForm: adding billing details and showing errors

- 6. Test with live credit cards

This guide walks you through the process of taking PaymentIntents into use. This article covers how PaymentIntents can be used with card payments. On general level, the steps are the same for other payment methods. See background article on payment methods and payment intents for more information. Stripe's PaymentIntent is a new way to handle Strong Customer Authentication (SCA) by using frictionless 3D Secure 2 authentication.

Before starting to read this article, you probably want to get familiar with Strong Customer Authentication and how PaymentIntent flow works by reading related background articles.

Note: Taking Stripe PaymentIntent flow into use, is a big change for CheckoutPage and includes process change. You should carefully check what kind of changes are made in FTW release: v3.0.0. Taking update from upstream or even cherry-picking commits might make the update easier, but you should first track your custom-code to affected components.

1. Process change

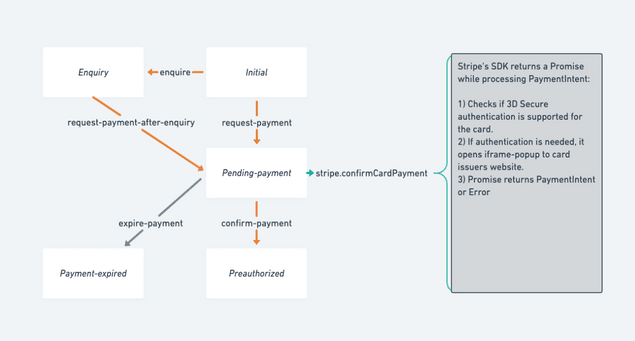

Stripe's Payment Intents API is a new way to build dynamic payment

flows. Its

automatic confirmation flow

helps a lot since all the authentication actions for a customer are

included in a single call: stripe.confirmCardPayment. When called,

Stripe's SDK checks if there's a need for Strong Customer Authentication

(SCA) and creates a popup to card issuer's website.

However, to be able to call confirmCardPayment, there needs to be a

new state to the transaction process. Because of this, we have split the

previous transition (Initial - request -> Preauthorized) into two:

So, after transitions (request-payment or

request-payment-after-enquiry), API returns

stripePaymentIntentClientSecret among the protected data of the

current transaction. This client-secret is used for the call to

stripe.confirmCardPayment. Then there is another transition made

against Marketplace API, so that it can confirm the PaymentIntent and

preauthorize the order. Transaction process continues normally after

that - i.e. Provider has to accept or reject the order.

Concrete steps here are changing the transaction process, then updating

bookingProcessAlias in config.js and making necessary changes to

src/util/transaction.js file. Remember, when transaction process is

changed, you need to go through all the files that import transitions or

utility functions from util/transaction. In practice, we made changes

to InboxPage, TransactionPage, TransactionPanel, ActivityFeed,

BookingBreakdown, BookingDatesForm, and CheckoutPage. The list

might be different if you have customized your components or process.

The default transaction process supports SCA, but if you have an older process version without PaymentIntents, you can see our new example processes here:

https://github.com/sharetribe/example-processes

All the example processes support SCA. If you need help with the concrete steps to customize your process to support SCA, contact Flex support from the support widget in Console and we'll guide you through the changes.

2. Add new thunk calls to stripe.duck.js

When using PaymentIntent flow, we don't need stripe.createToken

anymore, but we need to add two new thunk calls:

stripe.confirmCardPayment and stripe.retrievePaymentIntent.

stripe.confirmCardPayment is needed to provide SCA as mentioned

earlier. However, since customers are making several AJAX calls on

CheckoutPage, it is possible that there is a network error or

something else happening between those calls. Even the whole page, might

be reloaded at some point. We need to retrieve up-to-date PaymentIntent

from Stripe API and check its status to be able to continue the payment

process. This can be done with stripe.retrievePaymentIntent.

Note: previously

stripe.confirmCardPaymentwas calledstripe.handleCardPaymentwhich is now deprecated. Basically, handleCardPayment has been renamed to confirmCardPayment. In addition to the rename, Stripe has slightly modified the arguments. These changes should not affect the behavior of the method.

3. CheckoutPage: add new API calls and call them in sequence

The biggest change happens in CheckoutPage. When a user submits

StripePaymentForm and handleSubmit is called from CheckoutPage, new

data needs to be prepared (billing details: name, email, and billing

address) and then 4 thunk-calls/Promises need to be made in sequence:

Step 1. onInitiateOrder

- This tells Marketplace API to create booking and PaymentIntent

- Booking is created, so availability management blocks dates for conflicting bookings

- API returns

stripePaymentIntentClientSecretinside transaction's protectedData

- This combines both transitions:

sdk.transitions.initateakarequest-paymentsdk.transitions.transitionaka continue enquiry withrequest-payment-after-enquiry

- Automatic expiration happens in 15 minutes, if process is not

transitioned to

'transition/confirm-payment'before that. - Created transaction is saved to session storage or existing enquiry tx is updated. (There is more about this step later.)

Step 2. onConfirmCardPayment

- This is a call

stripe.confirmCardPayment - If the customer must perform additional steps to complete the payment, such as authentication, Stripe.js walks them through that process.

Step 3. onConfirmPayment

- This tells Marketplace API that customer has completed the payment requirements. API will validate and mark the payment confirmed in Flex.

Step 4. onSendMessage

- If the customer has added an initial message to the provider, the app sends that message after the payment is confirmed.

Note:

stripe.confirmCardPaymentneeds an instance of Stripe to be passed from StripePaymentForm.stripe.confirmCardPaymentwill check card details from connected Stripe Elements input.

4. CheckoutPage: save updated transaction

We use session storage to buffer checkout page against page reloads and errors - customer needs to be able to continue payment after accidental page refresh and network errors. This is a UX issue, but more importantly, it builds trust. Because of this need, we save booking dates and other data there. Previously enquiredTransaction was saved there too, but that concept is now expanded a bit: any transaction can now be saved to session storage under the key "transaction".

So, if there is an existing transaction in enquiry state and customer

books the listing, TransactionPage sends that transaction to

CheckoutPage. As a first step CheckoutPage saves received data to the

session store. This is pretty much the same functionality as with

previous card-token payment process - only the key is changed from

enquiryTransaction to transaction. However, after transition

request-payment (or request-payment-after-enquiry) the updated

transaction is saved again. (the relevant new data in transaction is

stripePaymentIntentClientSecret.)

In addition, the handling of booking breakdown with

SpeculatedTransaction needs to be changed because saved transaction

already contains booking in some cases and a new call to

sdk.transactions.initiateSpeculative would just return a conflict

error telling about an already existing booking.

5. StripePaymentForm: adding billing details and showing errors

Most of the visual changes happen in StripePaymentForm. Billing details are added to the form and most of the errors of different thunk calls are shown inside it.

The default mode for FTW is to show billing address fields. Even though

it is recommended by Stripe, you might want to remove those fields due

to UX reasons. That can be made just by not adding

StripePaymentAddress sub-component.

Note: if the page is reloaded after successful call to

stripe.confirmCardPaymentbilling details should not be shown to the user since credit card number and other billing details are already sent to Stripe.

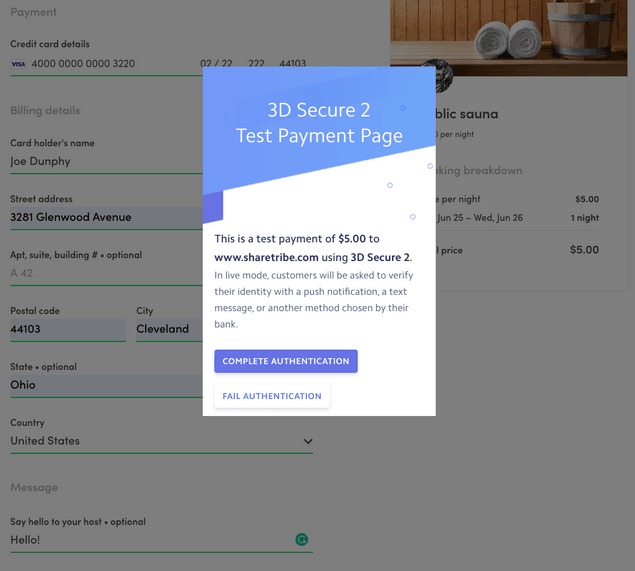

6. Test with live credit cards

Since 3D Secure authentication flow is different between different credit card issuers, you should test at least some credit cards how they work in a live environment.

This can be done by creating another live environment FTW instance that uses your live Client Id for Flex with live Stripe keys (both publishable and secret). Then create a new Git branch that takes PaymentIntents flow into use and adds Basic Authentication configuration into environment variables. After that, you could deploy your payment-intent branch into your live environment. Then you can just book some existing listing and maybe reject it to get refund to your live card account.