Last updated

How PaymentIntents work

Overview of how Stripe PaymentIntents work with Sharetribe, and how you can build your transaction process with support for Strong Customer Authentication (SCA).

Table of Contents

- Introduction

- Transaction process with PaymentIntents

- Example transaction process with card payments

- Example transaction process with both card and push payments

- Actions related to PaymentIntents

- stripe-create-payment-intent

- stripe-create-payment-intent-push

- stripe-confirm-payment-intent

- stripe-capture-payment-intent

- stripe-refund-payment

- Required actions in the client

- Handling Strong Customer Authentication

- Implementing the PaymentIntent flow

- Using PaymentIntents in Sharetribe

- Further reading

Introduction

PaymentIntents are a mechanism provided by Stripe to track the lifecycle of customer checkout flow. In addition, PaymentIntents provide tools for Strong Customer Authentication (SCA) where required. Sharetribe has built-in support for PaymentIntents and Strong Customer Authentication.

In September 2019 new European regulation will begin requiring SCA for online payments from European customers. In order to conform to these regulatory changes, Stripe encourages users to migrate or use PaymentIntents instead of directly creating Charges.

In the future, PaymentIntents can be required in other countries outside Europe due to local regulatory changes but they can already be used outside Europe. And if needed, they can provide fraud prevention with things like 3D Secure Card Payments.

PaymentIntents also allow a variety of payment methods to be used when making a payment in Sharetribe. See the overview of supported payment methods in Sharetribe.

This article will describe how PaymentIntents relate to Sharetribe transaction processes and the general principles of implementing a checkout flow with PaymentIntents.

Transaction process with PaymentIntents

On high level, the payment flow with PaymentIntents has the following steps:

- Customer initiates (or transitions) a transaction with a transition containing action that creates a PaymentIntent.

- Customer uses the PaymentIntent data to complete any steps necessary to authenticate and authorize the payment.

- The transaction can proceed only after customer has authorized (if required) the payment. The PaymentIntent is confirmed, resulting in a Charge being preauthorized (in the case of card payments) or fully captured (in the case of push payment methods).

- Transaction flow continues as usual onwards.

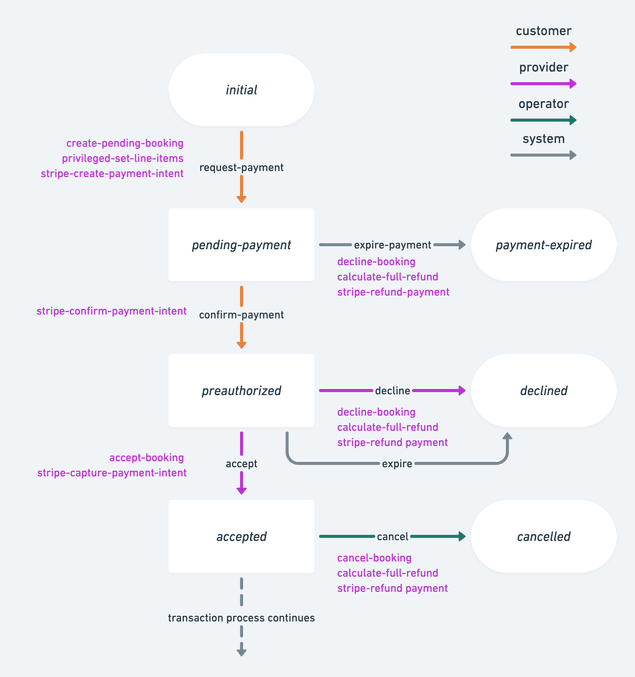

Example transaction process with card payments

For technical implementation of PaymentIntents, Stripe offers two approaches - manual or automatic confirmation flow. Sharetribe uses the automatic flow. In practice, the Sharetribe transaction engine models the automatic flow with two transitions. First transition creates the PaymentIntent (Step 1.) and second transition will validate and mark it confirmed in Sharetribe (Step 3.). Between these steps, the automatic flow pushes the responsibility of authenticating, authorizing and confirming the payment in Stripe to the client application (Step 2.). More information on the Step 2. can be found in this section.

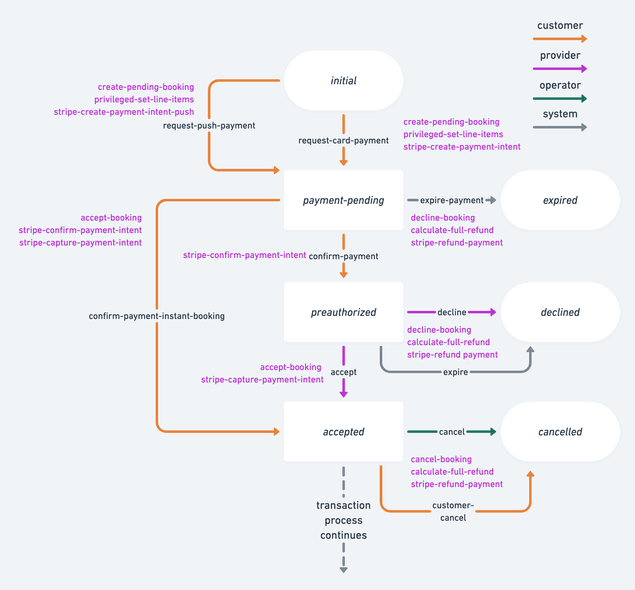

Example transaction process with both card and push payments

Since push payments do not have a preauthorization stage, this process allows an instant-booking type of flow, where the booking does not need acceptance from the provider.

You can find another example process with only an instant booking flow and support for both card and push payments in the Instant booking process in the Sharetribe example transaction processes repository.

Actions related to PaymentIntents

The following actions can be attached to a transaction process in order to implement PaymentIntent flow and are already present in the default flows.

stripe-create-payment-intent

Creates a PaymentIntent for use with card payments (or payment methods that are similar, such as Google Pay or Apple Pay). You can optionally pass in a PaymentMethod ID, or attach a PaymentMethod later to the transaction during the validation and confirmation in the client by using Stripe Elements. The latter is the recommended way and is covered in the implementation guide.

For detailed reference, see here.

stripe-create-payment-intent-push

Creates a PaymentIntent for use with push payments. You can optionally pass in a PaymentMethod ID, or attach a PaymentMethod later to the transaction during the validation and confirmation in the client by using Stripe Elements. The latter is the recommended way and is covered in the implementation guide.

For detailed reference, see here.

stripe-confirm-payment-intent

Validates that the transaction has a PaymentIntent created and verifies

via Stripe API that the PaymentIntent status is requires_capture,

requires_confirmation or succeeded (only allowed for push payment

methods). Confirms the PaymentIntent in Stripe, if needed.

If the payment intent was created with stripe-create-payment-intent (a

card payment), a preauthorization is placed on the card. The payment

then can be captured in full by using stripe-capture-payment-intent

within 7 days of creating the payment intent, or the preauthorization

can be released by using stripe-refund-payment.

On the other hand, if the payment intent was created with

stripe-create-payment-intent-push, there is no preauthorization, the

payment is captured in full and there is no need to use the

stripe-capture-payment-intent action. The payment can be refunded in

full using the stripe-refund-payment.

For detailed reference, see here.

stripe-capture-payment-intent

Captures a confirmed PaymentIntent. In case of PaymentIntents created

through stripe-create-payment-intent-push, the PaymentIntent is

automatically captured already when confirmed and this action has no

effect. Note that uncaptured payment intents are valid for seven days,

after which they are automatically canceled by Stripe.

For detailed reference, see here.

stripe-refund-payment

Either cancels an unconfirmed PaymentIntent or refunds the related captured charge.

For detailed reference, see here.

Required actions in the client

The required actions in the client are related to authentication and confirmation. You need to be able to handle potential authentication steps required by the customer's card issuing bank. After authentication, the client needs to obtain PaymentIntent data from the transaction's protected data and use that to confirm the payment.

In case you wish to enforce 3D Secure Card Payments for cards that support 3DS, in addition to supporting payment authentication in your client app, you may need to update your Stripe Radar rules.

Handling Strong Customer Authentication

Strong Customer Authentication is a potential step enforced by governmental regulation. Not every PaymentIntent for card payments will require customer authentication. For instance, authentication may not be required for:

- transactions out of scope of SCA

- e.g. when card issuing bank is outside of EEA

- merchant initiated transactions

- transactions that fall under an SCA exemption

- low value or low risk transactions

- recurring payments for fixed amount

- other

In addition, PaymentIntents for push payment methods also require customer action. Typically, the customer needs to be redirected to their bank website or app where they can complete the payment, after which they get redirected back to the marketplace.

This means that Sharetribe implementation of PaymentIntents supports payment flows that require authentication and those that do not. When implementing the PaymentIntent flow in the client you need to be prepared for handling both cases - payments requiring SCA and payments that do not. It might be impossible to know in advance whether the payment will require authentication, unless the marketplace and all its customers are outside of EEA.

The recommended way of implementing support for SCA is to use Stripe Elements that can provide you with ready modals for handling e.g. 3D Secure Card Payments. The next section will provide high level instructions on how to do this in the client.

Implementing the PaymentIntent flow

For implementing the PaymentIntent flow, you can use the following guides as a reference:

- card payments

- push payment methods:

Below we outline the concrete steps and how they work in combination with the Sharetribe transaction process.

Step 1: Initiate or transition a Sharetribe transaction

With Sharetribe, the step to create a PaymentIntent in handled by the transaction engine when a transaction transitions with a transition using one of the following actions:

- stripe-create-payment-intent - use this action for card payments

- stripe-create-payment-intent-push - use this action for payments with push payment methods

If we assume that your transaction process follows

this example,

you would use the request-card-payment transition for card payments

and the request-push-payment transition for push payments.

Step 2: Collect payment information and handle customer actions

Stripe Elements provides ready tools and a reference for implementing the automatic PaymentIntent flow. It is useful for both collecting payment details, attaching the PaymentMethod to the PaymentIntent, as well as handling any customer payment authentication or confirmation steps. It's the recommended way to support PaymentIntents in the client.

For card payments, your implementation will typically invoke a call to Stripe.js stripe.confirmCardPayment.

For push payments, the correct Stripe.js method depends on the concrete payment system. See here for a full list of Stripe.js methods.

In either case, you need the PaymentIntent's ID and client secret. Both

of those values are exposed in the transaction's protectedData map under

a key stripePaymentIntents after the PaymentIntent has been created.

The value of stripePaymentIntents is an object in the form of:

{

"default": {

"stripePaymentIntentId": "pi_1EXSEzLSea1GQQ9x5PnNTeuS",

"stripePaymentIntentClientSecret": "pi_1EXSEzLSea1GQQ9x5PnNTeuS_secret_Qau2uE5J5L6baPs8eLPMa2Swb"

}

}This data is only exposed to the customer in the transaction. The provider can not access neither the PaymentIntent ID nor the client secret.

Step 3: Transition the Sharetribe transaction further

Once any customer authentication or payment confirmation is handled in the UI, you need to transition the Sharetribe transaction further in order for Sharetribe to record the payment details correctly. Make sure that the transition includes the stripe-confirm-payment-intent action.

If we assume that your transaction process follows

this example,

you would use the confirm-payment transition for card payments and the

confirm-payment-instant-booking transition for push payments.

Using PaymentIntents in Sharetribe

The Sharetribe Web Template supports card payments with PaymentIntents by default. If you need to adjust the default implementation, or if you're currently using one of our legacy templates, learn more about how to take PaymentIntents into use.